A comprehensive look into Kraken’s Cryptocurrency exchange

Kraken is one of the most established cryptocurrency exchanges in operation. It provides institutional and retails users with an extensive range of features, including multi-fiat currency support, leveraged futures, margin trading, dark pools, and an OTC desk. The exchange also provides personal and business accounts, extensive customer support, and mobile apps that enhance the user experience for users of all levels of trading experience.

Kraken has been available to the public since 2013, and is regulated by FinCEN in the US. The exchange has developed a good reputation in terms of security and is one of a few crypto exchanges that provides fiat support for currencies such as the US Dollar, the Euro, the British Pound, the Canadian Dollar, the Australian Dollar, and the Japanese Yen. The exchange also enjoys high liquidity levels and continues to rank highly in terms of BTC/USD, BTC/EUR, and BTC/GBP trading pairs. As a result Kraken is often seen as one of the strongest competitors to other leading exchanges such as Coinbase and Gemini.

Key Features

Kraken is based in San Francisco, USA, and was founded by CEO Jesse Powell in July 2011 before its official public launch in September 2013. The exchange has grown into a full featured platform, and is one of the industry’s most established fiat/crypto exchanges. Kraken stands out in relation to security, reliability, and trading choices. It incorporates a range of features that appeals to both institutional and retail traders. These include:

- International Availability – The exchange is available around the world and supports fiat transfers in US Dollars, Canadian Dollars, Euros, the Great British Pound, Swiss Francs, and Japanese Yen.

- High Volume/Liquidity Levels – Kraken exhibits high levels of liquidity across the board which allows for faster trade execution and helps to attract active traders. Kraken is also the largest exchange by Euro volume, and often ranks among the top exchanges with regards to Bitcoin liquidity.

- Trading Options – The platform provides access to standard Spot trading and Futures trading with up to 50x leverage. Margin trading with leverages of 2x to 5x is also available, and the platform contains over 155 different markets and features comprehensive TradingView charts alongside a full range of Technical Analysis Tools. Kraken also provides extensive API key support to all users.

- Institutional Grade Services – Kraken incorporates bank grade security protocols, and also provides dark pool and OTC trading for institutional investors. Institutional accounts also benefit from high trading/withdrawal limits, private API key management solutions, and enhanced 24/7 customer service support.

- Mobile Apps – Mobile apps for both Android and iOS devices are available for both Kraken Pro and Kraken Futures. The apps are fully featured and allow traders of all types to keep an eye on their accounts while on the move.

Account Types

Kraken provides both personal and business accounts and categorizes accounts into three verification tier levels. The Starter, Intermediate, and Pro tier. Each require differing levels of KYC verification and provide access to various platform features.

- The Starter account – Doesn’t require you to submit any identification documents and is limited to crypto to crypto trading and a $5,000 daily withdrawal limit. This account also has a 2.5 XBT margin trading and a 16 API key generation limit.

- The Intermediate account – Requires ID and address verification and provides access to fiat deposit and withdrawals. It also comes with daily crypto/fiat withdrawal limits of $500,000 and $100,000 respectively. Alongside a 25 XBT margin trading limit and 16 API key limit.

- The Pro account – Requires additional verification, including the submission of financial statements. It comes with daily crypto/fiat withdrawal limits of $10m+. Pro account holders also get a 250 XBT margin trading limit and a 25 API key limit.

The Intermediate and Pro accounts also gain access to Kraken Futures, while the Pro account gains access to Dark Pool trading and the OTC desk.

Business Accounts

Pro account holders can also open a business account and make use of:

- Personalized deposit & withdrawal limits

- Access to Kraken’s Over-The-Counter Trading Desk

- Higher Margin Allowance limits

- Higher API limits

Deposits & Withdrawals

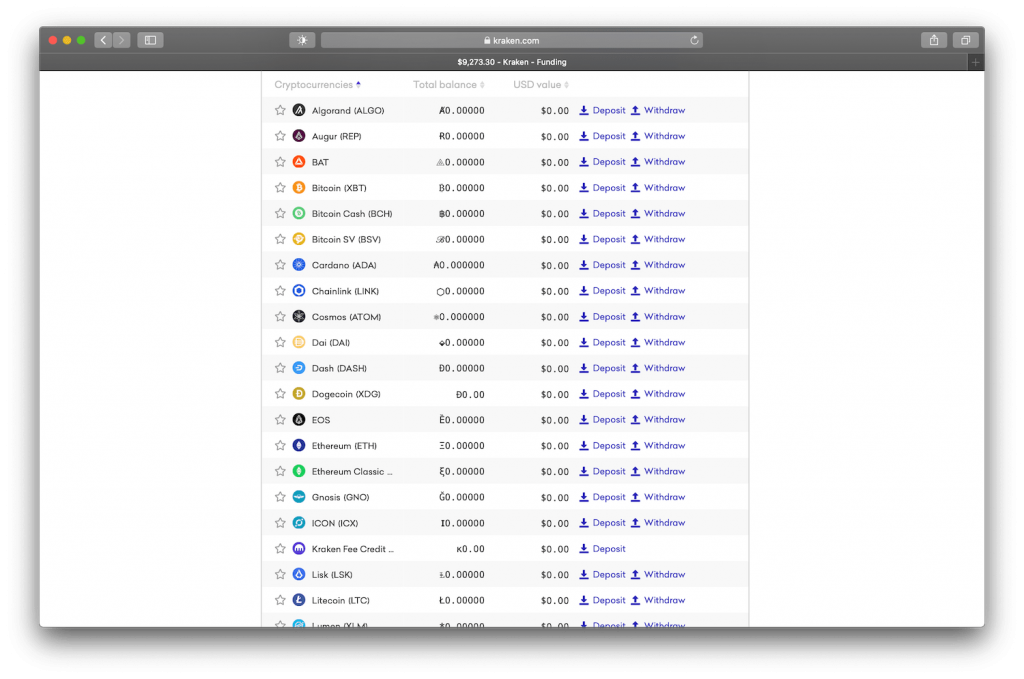

When using the platform, you can make both crypto and fiat transfers in order to fund your account. Making crypto transfers is generally more straightforward, and all account types can make unlimited crypto deposits.

Kraken does, however, limit withdrawal amounts. The Starter, Intermediate, and Pro accounts are limited to daily crypto withdrawals of $5,000, $500,000, and $10m respectively. All account holders are able to make an unlimited amount of crypto deposits and withdrawals within any given 30 day period.

Intermediate and Pro account holders are able to make fiat transfers with daily withdrawal limits of $100,000 for Intermediate and $10m for Pro. The monthly limit stretches to $500,000 for Intermediate, and $10m for Pro. All fiat deposits must match the same currency chosen in the deposit options as currency conversions are not possible. Any funds sent to the wrong deposit option will be returned and may result in extra charges.

Standard US Dollar deposits made by FedWire incur a $5 fee, and take one to three days to process. FedWire Etana Custody and SWIFT transfers are fee free, as are standard SEPA Euro deposits. SEPA Etana Custody and SWIFT Etana Custody Euro deposits are also fee free, with all Euro deposit options being eligible for instant transfers.

SWIFT Etana Custody deposits are free for anyone in Canada making CAD deposits, and the same is true for standard Canadian bank wire transfers. For Australians, AUD bank transfers are free and processed almost instantly for Osko enabled accounts.

For anyone in the UK, Kraken supports CHAPS and FPS/BACS transfers for a fee, while SWIFT Etana Custody GBP deposits are free. Japanese Yen deposits are also free, while Swiss Franc deposits incur a deposit fee depending on the transfer method. For a full list of the fiat deposit details you can check out Kraken’s fee description.

Trading

Kraken provides access to a number of spot trading markets that include 35 crypto to crypto trading pairs, and about the same number of fiat/crypto trading pairs. The exchange also supports trading in the following fiat currencies: USD, EUR, CAD, JPY, GBP, CHF, and AUD.

Kraken supports trading in popular cryptocurrencies such as Bitcoin (XBT), Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC), Dash (DASH), Monero (XMR), ChainLink (LINK), EOS, XRP, Basic Attention Token (BAT), and PAX Gold.

The platform also supports stablecoins such as and Tether (USDT), USD Coin (USDC), and DAI. For a full list of all the currencies supported by Kraken, you can click here.

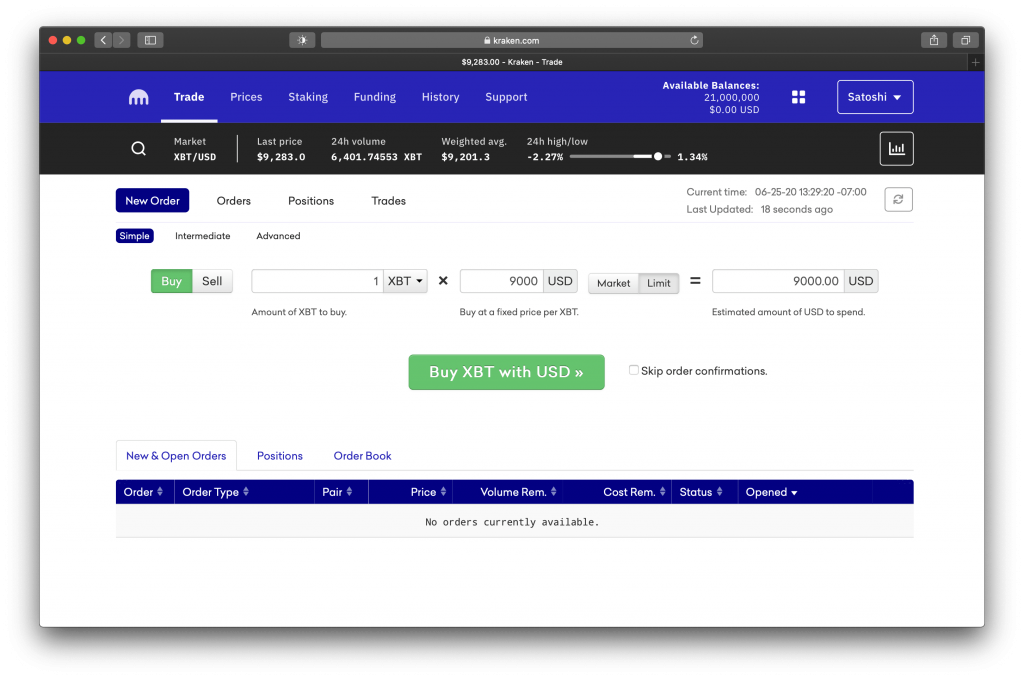

The exchange provides users with two ways of trading cryptos. The first is a simple order form and is straightforward. You can navigate to the “Trade” tab within your account, and then select the pair you want, then click on the “New Order” page and choose the “Simple” form.

Here you can place simple market or limit buy/sell orders by entering your desired amounts and prices before going on to confirm your order.

The platform also incorporates a more traditional trading interface which supports TradingView charts, and provides access to a wide range of technical analysis tools and indicators. This interface contains all the advanced trading features and allows you to place Limit, Market, Take Profit, Stop Loss, or Trigger Entry orders.

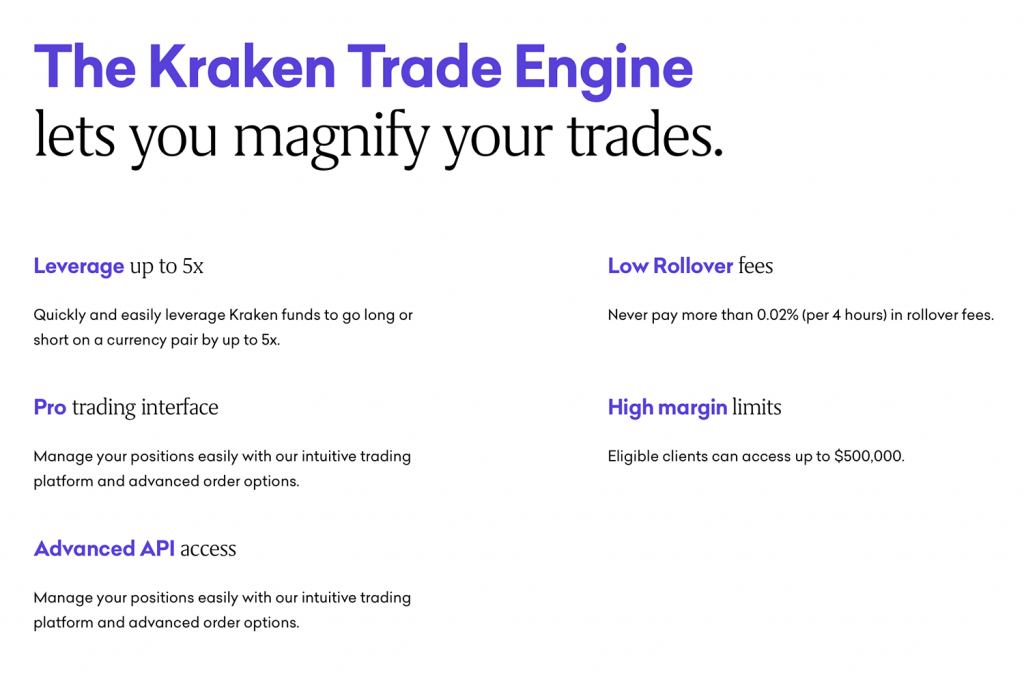

Margin Trading

Kraken allows its users to open positions larger than the balance of their accounts via margin trading. Through the use of leverage, traders can increase the size of their orders, and boost their profit potential.

Traders can make use of leverage ranging from 2x to 5x on the platform. When placing a margin trade with a leverage of “2.0”, only half of the size of this position is required as initial margin, and when using “5.0” leverage, then only a fifth is needed. This enables you to open larger positions than what your account would normally allow. However, this is a trading method best left to the experienced as it can lead to larger losses.

Margin trading pairs eligible for 5x leverage include: XBT/USD, XBT/EUR, ETH/USD, ETH/EUR, ETH/XBT, XRP/USD, and XRP/EUR.

A range of other cryptocurrencies can be traded using leverage ranging from 2x to 4x. You can view the full list here.

Margin trading limits depend on your account verification level. Starter, Intermediate, and Pro accounts come with trading limits of $5,000, $50,000, and $500,000 respectively. The same figures apply to anyone trading in Euros, while GBP margin trading is restricted to £1,000, £10,000, and £20,000 across the three accounts.

Bitcoin margin trading is restricted to 2.5 XBT, 25 XBT, and 250 XBT, while Ethereum margin trading is limited to 25 ETH, 250 ETH, and 2,500 ETH across the three accounts

Kraken Futures is available to the following account holders:

- Personal clients: Intermediate or Pro verified

- Corporate clients: Pro verified

Account holders must also reside in a supported jurisdiction (not the US). You can access Kraken Futures by clicking on the Launchpad in your account, then selecting “Futures Trading”. You will be required to agree to the Terms and Conditions, as well as complete the investor questionnaire.

Fees

Trading Fees

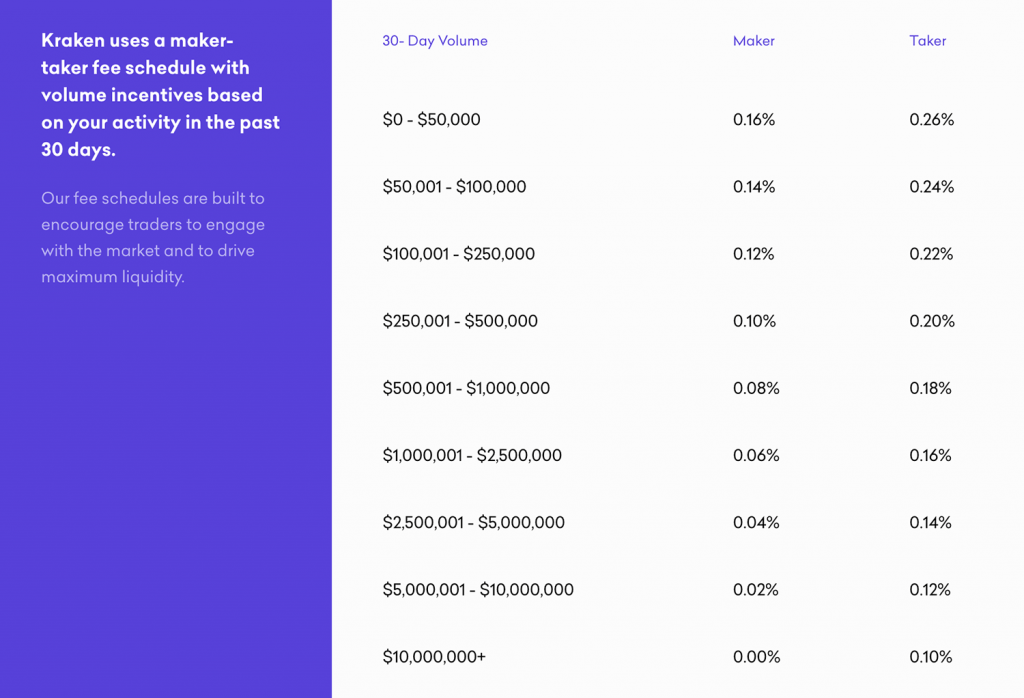

Similar to the majority of leading exchanges, Kraken uses a maker-taker fee schedule, which aims to incentivize market makers to add to the order books and increase liquidity. Fees are charged on a per-trade basis, and fee volume levels are measured and applicable for trades that have taken place within the last 30 days.

Users with a 30 trade volume ranging from $0 – $50,000 incur maker fees of 0.16% and taker fees of 0.26%. The exchange uses a tier system which eventually sees maker fees reduced to 0.00% and taker fees falling to 0.10%.

The full trading fee schedule is as follows:

The maker/taker fee rates change slightly when applied to FX pairs (EUR/USD), and whenever a stablecoin is used as the base currency (e.g. USDT/USD, DAI/USDT).

When stablecoins acts as the quote currency (XBT/DAI), then the general trading fee schedule applies. Here, maker and taker fees start out at 0.20% for users with a 30 trade volume ranging from $0 – $50,000, and fall to 0.00% for anyone with a 30 day trading volume in excess of $1,000,000.

Kraken also operates dark pools for people making larger trades, and don’t want to deal with slippage. Maker/taker fees start out at 0.36%, and fall to 0.20% for anyone conducting over $10,000,000 worth of trades within a 30 day period.

Margin Fees

Kraken applies additional fees to anyone engaged in margin trading. These fees are applied on top of trading fees at the opening and closing of margin positions. It’s also worth noting that clients with accounts registered in the U.S. are limited to a 28-day maximum term for maintaining opening margin positions, while platform users with accounts registered outside the U.S. have a 365-day maximum term limit.

With regards to Bitcoin (XBT) margin trading, when EUR or USD act as the Quote Currency, the opening fee is 0.01% with a rollover fee of 0.01% per 4 hours. When GBP, CAD, or USDT act as the Quote Currency, then the opening fee is 0.02% with a rollover fee of 0.02% per 4 hours.

Margin trading fees range from 0.01% to 0.02%. To get the full run down of all the trading fees applied by Kraken, you can check out their Fee Schedule.

KYC Verification

As a cryptocurrency exchange that also supports fiat currency transfers, Kraken requires all of its users to verify their identity in order to open accounts. In addition, the platform is not available to anyone located in the following countries:

- Afghanistan

- Cuba

- Guinea-Bissau

- Iran

- Iraq

- Japan

- North Korea

- Tajikistan

Services are also restricted to anyone residing in Washington State (WA) or New York (NY) in the US, while residents of New Hampshire (NH) and Texas (TX) cannot deposit, hold, nor deal in EUR on the platform.

Kraken operates three verification tier levels, namely, Starter, Intermediate, and Pro and each tier requires your email address, full name, physical address, phone number, and date of birth. The Starter account doesn’t require the submission of any ID or proof of address documents, but these accounts are unable to make fiat deposits and withdrawals.

The Intermediate and Pro accounts require the submission of a valid photo ID and a proof of address document, alongside your occupation details, and Social Security Number (SSN) for US residents. These accounts provide access to fiat currency transfers, alongside additional features such as the ability to trade on Kraken Futures, Dark Pools and OTC desk.

In order to get verified, you’ll need to create/login to your Kraken account, click on your profile icon in the upper-right corner of the page, and then click on “Get Verified”. You’ll then need to follow the verification process and make sure to have all the supporting documents. To find out more about the Kraken verification process, you can click here.

Customer Support

Kraken incorporates pretty extensive customer support, and operates a 24/7 live chat system which allows platform users to chat with support agents in a range of different languages. The team can be contacted by email, and users can submit support tickets from within their accounts. The team are also active on social media, and can be followed on Facebook and Twitter.

The Support Section is comprehensive and includes a wide range of resources aimed at helping users to navigate the platform. There are a number of guides and articles that cover trading, futures, account security, and how to make fiat deposits and withdrawals. In addition, the team runs a blog, and publish regular podcasts that keep people informed of all the latest developments within the Kraken ecosystem, and greater crypto community.

All in all, Kraken runs one of the more comprehensive support desks in the crypto industry with the main issue being the amount of time it takes to get a reply during peak trading periods.

Kraken Security

Kraken has developed a reputation as being one of the most secure crypto exchanges, and has managed to remain resilient to any major hacks since its inception. An illustration of this, is the fact that the Mt. Gox administration team chose Kraken to help process payments to creditors after they filed for bankruptcy.

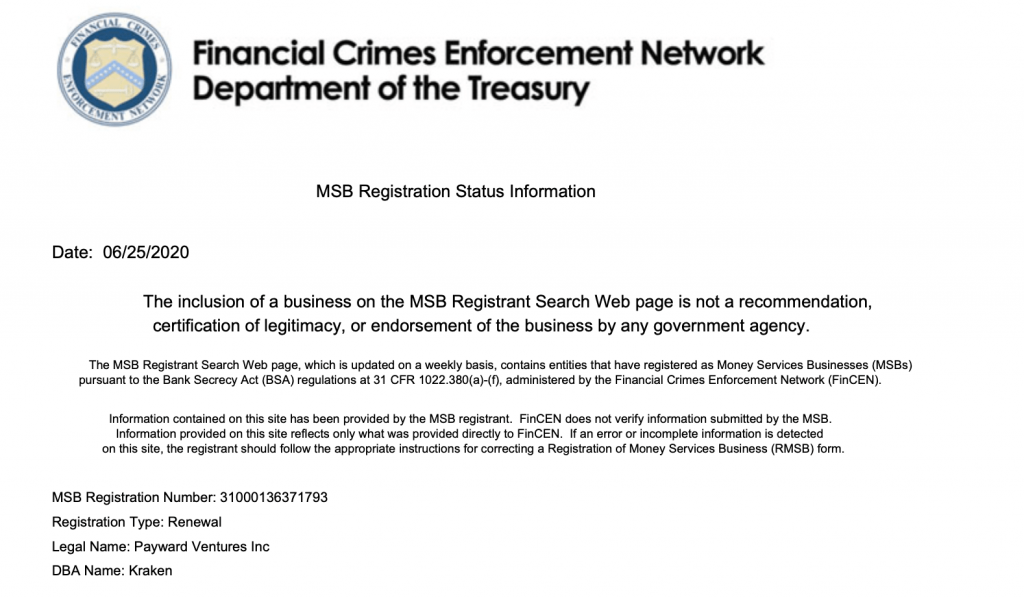

Kraken is also regulatory compliant in every jurisdictions that it operates in, and is registered as a Money Services Business (MSB) with FinCEN in the USA (reg no 31000136371793) and FINTRAC in Canada (reg no M19343731).

The exchange is also regulated by the Australian Securities & Investments Commission with registration numbers of ABN: 42 163 237 634 and ACN: 163 237 634. The Kraken Futures are regulated by the Financial Conduct Authority (FCA) in the UK with a reference number 757895.

Additionally, the exchange incorporates a wide range of security protocols, including keeping 95% of all deposits in offline, air-gapped, and geographically distributed cold storages. Kraken also makes use of institutional grade security protocols, and encrypts all sensitive account information at the system and data level.

Full SSL encryption is used to protect the site, while emails can also be PGP signed and encrypted. User accounts are also secured using two factor authentication (2FA) which can also be set up to make use of a physical device like a Yubikey.

The team also conduct regular penetration testing and constantly monitor their platform in real-time to spot any suspicious activity. Kraken holds full reserves, and employs an independent, cryptographically-verified audit firm, to prove to any third parties that customer funds are properly held.

As a result, Kraken is one of the most trustworthy cryptocurrency exchanges and is a secure choice for both individual and institutional users.

Conclusion

Having been around since 2011, Kraken has developed a reputation as a secure and reliable crypto exchange, and is one of the most viable alternatives to Coinbase and Gemini.

The Exchange is regulatory compliant, and offers both a simple and complex trading terminals, which appeals to new crypto traders and veterans alike. Users can trade Spot, Margin, and Futures, all in one place. The high liquidity levels, Grade A security, and complete transparency, makes it especially appealing to institutions and high frequency traders.

The exchange suits anyone looking for a secure and reliable platform to trade highly liquid cryptos, but may not be the best choice for anyone looking to trade a wide range of assets. Additionally, privacy advocates may not be thrilled to give up so much personal information, in order to use the the advanced features on the platform.

While it may not appear to be as exciting as FTX or Bybit, or be as popular as Coinbase, Kraken does offer something to traders of all experience levels. It is one of the most trusted and reliable exchanges in operation.