A review of the best cryptocurrency debit cards available today

One of the underlying problems of digital currencies is that they lack instant liquidity, thereby affecting their potential as a means of payment. Of course, this problem could be easily dealt with if merchants worldwide were more open to the world of cryptocurrencies. However, this is only bound to happen as mass adoption grows, therefore creating a paradox: mass-adoption cannot be attained if merchants refuse to process crypto-based payments, whereas this refusal will continue if users do not demand this service.

Indeed, cryptocurrency exchanges are great when it comes down to converting cryptocurrencies to fiat, but they have their limitations. Withdrawals to bank accounts and debit cards take time – thus, crypto-based money is not easily accessible when required for day-to-day spending.

A current solution to this problem is the use of cryptocurrency-based debit cards. Providers of such cards allow users to deposit bitcoin and other coins into an online account that converts the coin to fiat whenever users wish to spend money. ATM withdrawals, in-store payments and online transactions can all be carried out via these cards, directly from one’s cryptocurrency holdings.

Over the last couple of years, multiple companies have launched such services, in collaboration with Visa and MasterCard. This article will focus on reviewing the market’s best cryptocurrency debit cards. Readers will learn more about their main features, perks, rewards, fees, and geographic restrictions. A pros and cons table will further highlight the main advantages and disadvantages of these providers.

Top Cryptocurrency Debit Cards

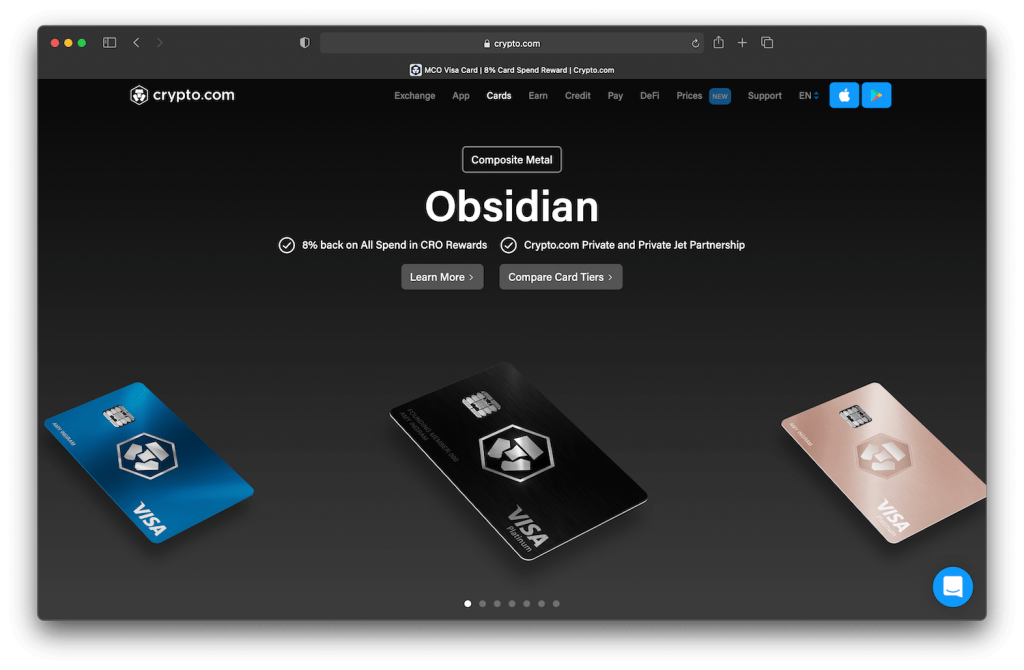

1. Crypto.com

About the platform

Crypto.com represents one of the world’s most popular crypto debit card providers. Founded in 2016, the company believes that people throughout the world should have the liberty of freely controlling their online money, identity, and data. So far, the platform has attracted over 2 million users.

Crypto.com provides a digital currency-funded MCO debit card, alongside a series of other services. These include a fully-fledged exchange platform, a DeFi and crypto wallet, the ability to stake coins in exchange for interest, a crypto payment processing platform, and a lending service.

The crypto debit card can be funded via crypto deposits, which are instantly converted to the user’s currency of choice. Payments and ATM withdrawals are supported wherever Visa is accepted.

In regards to the lending service, users can deposit crypto as collateral and obtain an instant loan in USD, PAX, USDC or TUSD. The credit can be spent directly via the company’s Visa card. Improved interest rates are granted to those who stake CRO, a native token enabling cross-asset currency settlement within the Crypto.com blockchain.

Perks and rewards

When signing up for a Crypto.com card, users can choose to stake CRO in order to obtain perks and rewards. CRO is obtained either by purchase or as a reward for spending via the card. Higher CRO staking will gain you access to improved card tiers.

With this in mind, users can unlock cashbacks together with free Spotify, Netflix, and Amazon Prime subscriptions. Expedia and Airbnb discounts are available as well. High tier card owners will unlock bonus interest, a private concierge, a merchandise welcome pack, access to airport lounges, and higher no-fee limits.

Geographical restrictions

The Crypto.com MCO debit card is unusable in several countries, due to regulatory struggles. Some of these nations include Congo, Haiti, Iraq, Iran, Gambia, Liberia, Macedonia, Sudan, and Montenegro.

Fees

Fees and limits are dependent on your debit card tier. Debit card holders will pay a 2% ATM withdrawal fee after surpassing the free limit. A 0.5% interbank exchange is charged after exhausting the monthly exchange limit.

Pros | Cons |

|---|---|

| • Multiple crypto services | • Large perk difference between tiers |

| • Great perks and rewards | • Overwhelming interface |

| • Can spend loans via debit card |

2. Nexo

About the platform

Founded in 2018, Nexo represents an innovative crypto-based banking platform that offers a variety of fintech services to over 800,000 users in 200+ jurisdictions.

At this point in time, Nexo offers 3 key services: a cryptocurrency debit card powered by MasterCard, a lending platform for cash and stablecoins, and an earning service that allows users to obtain daily compounding interest on their crypto and fiat deposits.

In regards to the Nexo debit card (which is still in the early access phase), customers can fund the card using crypto and spend its afferent value by either withdrawing from ATMs, making online purchases, or buying things in-store via POS devices. The card is accepted by over 40 million merchants worldwide, allows payments in multiple local currencies, and acts as a credit card when lending from Nexo. The Nexo platform also allows the creation of free virtual crypto cards.

Securing a loan via Nexo is as straightforward as it gets. Simply deposit and collateralize a specific amount of cryptocurrency in order to unlock a cash or stablecoin-based credit line. Approval is automatic and no credit check is required. Loans up to $2 million are possible, depending on the amount of collateralized crypto.

Perks and rewards

Nexo card owners can obtain 2% cashback on all purchases, payable in BTC, or the NEXO native token. A 10% daily compounding interest rate is obtainable by users who are interested in staking their coins.

Geographical restrictions

Nexo is currently unavailable in a number of countries including but not limited to Afghanistan, Bulgaria, Cuba, Congo, Estonia, Iran, Iraq, North Korea, Syria, Sudan, Yemen, and Zimbabwe.

Fees

Debit card withdrawals and cryptocurrency payments are processed at no extra cost. The same principle applies to FX transactions. Users can borrow cash or stablecoins at a 5.9% APR.

Pros | Cons |

|---|---|

| • Staking and lending possible | • Slightly confusing loan-to-value limits |

| • No fees for payment processing | • Lacks in-app crypto exchange |

3. Bitwala

About the platform

Bitwala’s journey began a few years back as a Bitcoin debit card provider. Back then, they issued Visa-based debit cards via which users could easily spend their deposited crypto. Now, the company has become a digital fintech bank, filled with multiple features.

With this in mind, users who complete the on-boarding process will unlock a fully serviced bank account with all of the standard bank features. With a German bank account, users can make transfers, set up recurring payments, or receive money. Both cryptocurrencies and fiat are supported. The MasterCard integration allows for crypto spending to millions of merchants worldwide. Coin ownership is non-custodial and secured via private keys.

Users are also given the possibility of investing in cryptocurrencies, through the trading service that allows the purchase and sale of digital assets, directly from the bank account. Lastly, Bitwala also provides an earning feature – users who deposit crypto can earn up to 4.51% interest every year on their bitcoin.

Perks and rewards

Bitwalla does not provide any of the standard perks and rewards that other competitors may offer. This decision somewhat makes sense, given the fact that Bitwala was designed to function as a cryptocurrency-friendly bank, rather than as a singular crypto debit card.

Geographical restrictions

At this point in time, the Bitwala cryptocurrency debit card is only supported for residents located in countries that are part of the European Economic Area (EEA). Support for Switzerland is also offered.

Fees

Card ownership entails no fees. Thus, users can access free deposits, SEPA transactions, and ATM withdrawals. When it comes down to trading, a fee of 1% applies to all transactions.

Pros | Cons |

|---|---|

| • Zero fees for most services | • Numerous geographical restrictions |

| • Fully-fledged bank account | • No extra perks and rewards |

4. BitPay

About the platform

BitPay was founded in 2011 with the purpose of revolutionizing the market for crypto-related financial services. They offer multiple services, suited to both business and personal purposes.

BitPay is known for bridging the gaps that stand against mass-adoption. Merchants can therefore integrate BitPay’s services to facilitate the acceptance of crypto-based payments. Customers can smartly manage and spend their cryptocurrencies using the BitPay wallet. Lastly, BTC can be exchanged to dollars for spending purposes, via the prepaid MasterCard.

Cool features such as easy backups, multi-signature wallets, and gift card support, further enhance BitPay’s service portfolio. In regards to the debit card, payments can be made to millions of merchants throughout the world.

Perks and rewards

BitPay does not offer specific perks or rewards. However, once users set up their account, they get to unlock all of the features offered by this provider, such as instant reloads, payment flexibility, enhanced security, and worldwide payment support.

Geographical restrictions

At this point in time, the BitPay card is unfortunately only available to US residents, in all 50 states. No support is given for the European Union or other countries. The card, however, can be used to make payments worldwide, anywhere MasterCard is accepted.

Fees

Users can expect to pay a $10 card issuance fee, $2.5 for each ATM withdrawal, and an international currency conversion fee of 3%. Card loading and transactions remain free.

Pros | Cons |

|---|---|

| • Competitive exchange rates | • Card is only available to US residents |

| • Great merchant integration | • Inactivity fee of $5 per month |

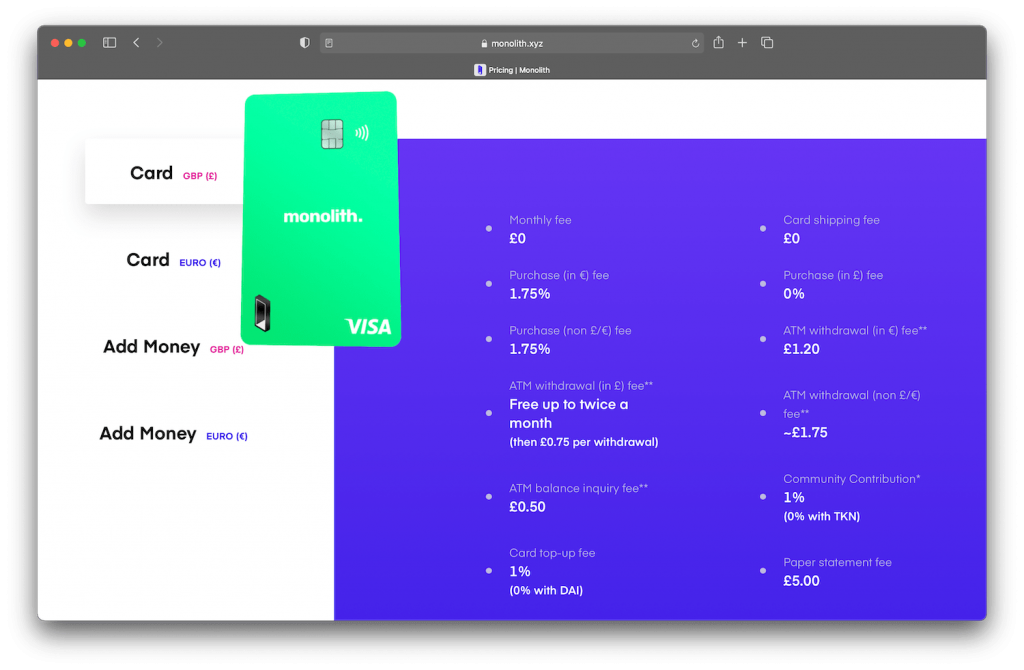

5. Monolith

About the platform

Monolith is a new fintech platform which serves the purpose of providing an all-inclusive Defi trading solution. With this in mind, users can access a Visa debit card that’s connected to a non-custodial cryptocurrency wallet, via which Ethereum and token-based payments can be sent to merchants throughout the world.

Thus, it is quite different when compared to some of the other solutions listed in this article. First off, bitcoin is not supported. Secondly, users are free to swap, spend, borrow, and earn interest through the DeFi market, via their Monolith accounts. Some of the supported tokens include, but are not limited to ETH, SAI, MKR, DAI, TKN, and others.

Furthermore, an European IBAN will soon be offered, therefore further expanding Monolith’s service catalogue. Future plans include support for receiving salaries directly into DAI.

Last but not least, Monolith is open source. It integrates multiple security protocols into a sleek and artistic user design.

Perks and rewards

Apart from the perks featured in the service catalog, TKN holders can claim their share of community contribution fees. Other rewards such as free subscriptions are not currently provided.

Geographical restrictions

Monolith’s contract wallet is available throughout the world, without having to go through a KYC procedure. However, the Monolith card is only available to residents of the European Economic Area, a few AFTA countries, and a number of special member state territories. With this in mind, the service is restricted to Asian and American countries.

Fees

From a pricing standpoint, Monolith charges a 1.75% euro purchase fee, £0.75 per ATM withdrawal, and a 1% card top-up fee. DAI and TKN users can access cheaper services. There’s no monthly, card shipping, or crypto/fiat exchange fee.

Pros | Cons |

|---|---|

| • Integrated with the DeFi markets | • Does not service US citizens |

| • Supports ERC20 token spending | • Does not support Bitcoin spending |

6. Binance

About the platform

Binance represents one of the world’s most popular cryptocurrency exchanges, with a daily transaction volume worth over $2 billion. The company aims to become a one-stop market for everything crypto-related.

With this in mind, the exchange has recently launched its very own cryptocurrency debit card, which users can leverage to send crypto to tens of millions of merchants worldwide.

Using the card is as simple as it gets. After completing the onboarding process, customers can simply convert multiple cryptocurrencies from their exchange spot wallet to fiat currencies that will be deposited on the card wallet.

Perks and rewards

The Binance card has a series of perks and rewards. Users are eligible to earn up to 8% cashback on most transactions they make using the card. Do keep in mind the fact that transactions are processed instantly – users can keep their crypto in coin format, and only exchange when they need the cash. In the perks section, Binance also mentions that they take fund safety very seriously, by implementing strict protocols capable of ensuring security.

Geographical restrictions

The card is available throughout the European Economic Area, and there are plans to get it shipped to the United States and Russia as well.

Fees

The Binance card is free. The company does not charge processing or administrative fees. They do, however, mention that third party fees may apply depending on how the card is used.

Pros | Cons |

|---|---|

| • Supports multiple cryptocurrencies | • Only available within the EEA |

| • No administrative or processing fees | • Slightly confusing interface |

| • High cashback percentage |

7. Revolut

About the platform

Revolut is one of the world’s newest revolutionary fintech platforms. At its core, the platform provides a non-crypto debit card that can be used to instantly transfer funds between users, make payments, exchange currencies, earn interest, and withdraw from ATMs. Users also receive an IBAN account number for bank-based transfers.

While Revolut offers cryptocurrency support, it’s quite different when compared to its competitors. Revolut does not facilitate actual purchase of cryptocurrencies. Rather, users can buy and sell crypto exposure, meaning that they never hold actual digital assets, nor can they make transfers via the blockchain network.

As such, Revolut’s service is labeled as an investment method. Customers can purchase and sell crypto exposure via their account in order to earn profit generated by market price swings. The ‘crypto’ holdings can then be sold and spent via the fiat-only debit card. Cryptocurrency owners cannot deposit their coins to Revolut using a third-party wallet.

Perks and rewards

Revolut offers multiple features and cool perks. To name a few, users can leverage zero-fee international transfers, create saving accounts, leverage analytics to understand their spending, and access 28 supported fiat currencies. Depending on your card type, you may be eligible to earn cashback on purchases, as well as other rewards, such as airport business lounge passes, insurance, and better interest rates.

Additionally, all Revolut-held funds are protected via multiple security protocols and insurance policies.

Geographical restrictions

At this point in time, Revolut is available in all EEA countries, alongside Switzerland, Australia, and the United States.

Fees

There are 3 main card formats – standard, premium, and metal. The standard plan is offered free of charge, whereas premium costs $9.99 per month, and metal costs $16.99 per month. There’s a 2.5% cryptocurrency exchange fee for standard cardholders.

Pros | Cons |

|---|---|

| • Incredible user interface | • Only indirect access to cryptocurrencies |

| • Instant exchanges | • High crypto exchange rate |

| • Feature-rich platform |

Crypto Debit Cards Compared

| Card | Issuer | Borrowing | Trading | Interest | Perks |

| Crypto.com | Visa | Yes | Yes | Yes | Cashbacks & subscriptions |

| Nexo | MasterCard | Yes | No | Yes | Instant 2% cashback |

| Bitwala | MasterCard | No | Yes | Yes | No extra perks |

| BitPay | MasterCard | No | No | No | Instant reloads |

| Monolith | Visa | Yes | Swap | Yes | ERC-20 Token Swaps |

| Binance | Visa | No | Yes | No | Up to 8% cashback |

| Revolut | MasterCard | No | Yes | Yes | Instant cashback |

Bottom Line

Based on everything that has been outlined so far, there are multiple pros and cons to each of these cards. While making the right choice may be a bit difficult, it is our belief that crypto debit cards can bridge the gaps between cryptocurrencies as an emerging technology and fiat money.