A comprehensive analysis of the best Coinbase alternatives

Shockingly, there are over 254 different cryptocurrency exchanges trading a combined market capitalization over $300 billion. But what exactly is a crypto exchange? In short, it’s a business that acts as a marketplace where buyers and sellers can come to exchange digital currencies for fiat money or other digital currencies. For some investors, the exchange also doubles as a coin tracker and digital wallet.

Coinbase: A Quick Overview

In recent years, Coinbase has risen to the top of the digital currency exchange pack. Coinbase offers something for everyone, making the job of buying, storing, and selling cryptocurrencies relatively straightforward. Headquartered in San Francisco, the company has even forged partnerships with businesses, most notably Overstock and Dell.

Not everyone is sold on Coinbase. This leading exchange has run into a host of problems that may cause some to be wary. In March 2018, the news organization Quartz reported a doubling of customer complaints against the exchange giant. More recently in June of 2019, the exchange’s servers crashed, sending Bitcoin price plummeting $1,400 within minutes. If these problems weren’t enough, the IRS hit 10,000 Coinbase customers with warning letters regarding federal tax law transgressions.

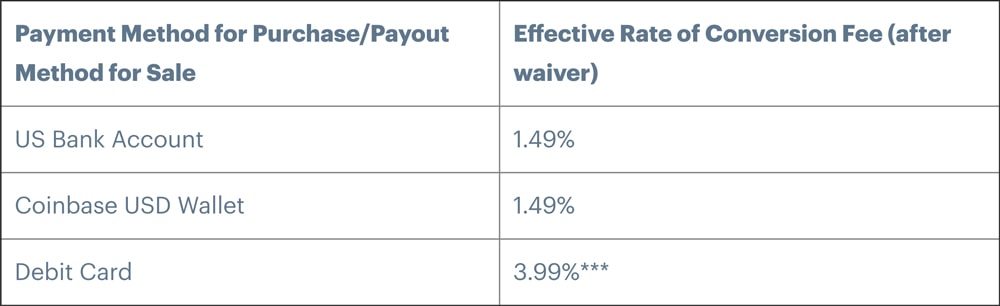

Modern investors know that exchange fees are an important component of a successful trading strategy. Exorbitant fees can squeeze profits from each trade. As of this writing, Coinbase charges a spread of 0.50% on the buying and selling of cryptos, plus additional fees that can go as high as a whopping 4%, shown below.

Users are not shying away from expressing their dissatisfaction with Coinbase. a Twitter trend started back in March of 2019 with the hashtag #DeleteCoinbase after the exchange announced its acquisition of Neutrino, a software organization that was founded by a team of well-known hackers and spy-wear developers.

The company is also facing a negligence suit for Bitcoin Cash’s launch back in 2017, with accusations of insider trading and manipulation. With these disadvantages in mind, many investors are starting to look for other exchanges.

Coinbase Alternatives: What to Consider?

There are several factors to consider when choosing an exchange. While fees are a key consideration, they aren’t the only dimension to examine.

- Supported countries

- Security

- Reputation

- Cryptocurrencies supported

- Fees, commissions, exchange rates

- Payment methods

- Geographic location

- Ease of use

- Verification requirements

Try beginning from the top, going down the list one by one as you consider an exchange.

For example, increasing regulatory pressure has forced many exchanges to stop supporting US-based customers. If an exchange is available, consider if it has the necessary security in place to all-but-guarantee your precious coins won’t vanish. After that, make sure the exchange is held in high regard and that it trades the cryptocurrencies you want to deal in. Last, but certainly not least, consider the fees imposed by the exchange. Low fees equal more money in your pocket.

Top 7 Coinbase Alternatives

With the above guidelines in mind, we have selected five exchanges that every savvy investor should consider. They are:

- Liquid – Best up-and-coming

- Gemini – Best for institutions and whales

- Binance – Best for volume & crypto options

- Bitstamp – Best for overall lowest fees

- Kraken – Best for trading tools provided

- BitMEX – Best for margin traders

- IDEX – Best DEX

Let’s dive into each exchange, the pros and cons, and the fee structures.

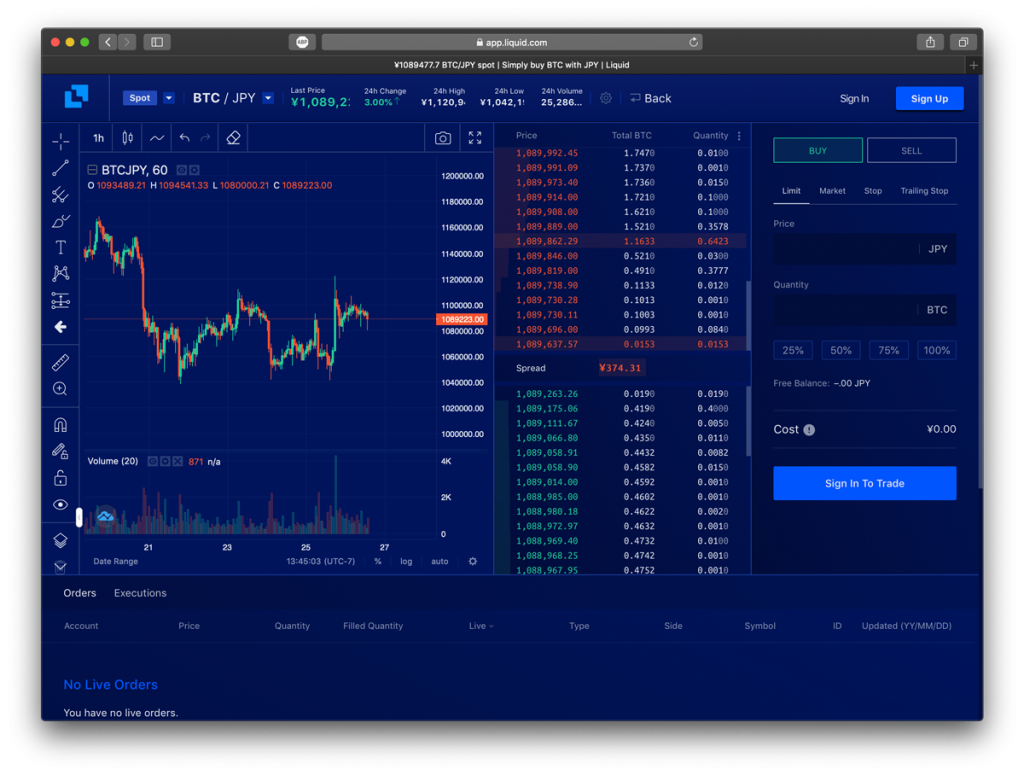

Liquid

This Japan-based exchange has had an impressive record so far. In just a span of two years, Liquid achieved “high liquidity” status, by clocking in over $250 million in daily trading volume, all whilst not yet serving the US market. The company has an impressive roadmap and focuses on regulatory compliance.

Pros:

+ Competitive fees

+ Margin trading of up to 100x

+ 80+ cryptos, +200 trading pairs

+ Regulatory compliance

Cons:

– Not available in US markets (yet)

Fees:

| Trading: | 0.05% when using QASH (native exchange currency) |

| Withdrawals: | Cryptocurrency – None, Fiat – 5 USD |

| Deposits: | None |

Additional Info:

- Mobile app available on iOS and Android and is fully functional. You can execute margin trades, view your balances and look at charts

- Liquid exchange is scheduled to launch its US-based entity in 2020

Besides not being available for US residents, it is difficult to find any cons for Liquid. The exchange has listed over 80 different cryptocurrencies to trade from, has competitive trading fees, offers margin trading, fully functional mobile app, and is fully licensed and compliant in Japan, the company’s headquarters.

Full throttle growth seems to be the name of the game. Once Liquid launches in US markets, it is very easy to imagine it leading the board in terms of trading volume. It’s UI and features appeal to both beginners and more advanced traders.

Gemini

This US-based exchange founded by the Winklevoss twins was the first fully regulated exchange, an important step towards legitimizing cryptocurrencies world-wide. The exchange trades in the following cryptos: Bitcoin, Ethereum, Ripple, Litecoin, Zcash, and Bitcoin Cash.

Pros:

+ Good security measures

+ Discounts up to 0% for volume traders

+ Regulation equates to trust for many investors

Cons:

– Relatively low 30-day volume

– Available in limited markets

– No margin trading

– A limited list of cryptocurrencies (6 total)

Fees:

| Trading: | 0 – 0.1% and up to 1% depending on the trade structure |

| Withdrawals: | Cryptocurrency – Up to 0.002 BTC, SEPA/Wire/Debit card – none |

| Deposits: | Cryptocurrency – none, Wire – none, ACH – none |

Additional Info:

- ACH bank transfers are limited to a maximum of $500 a day

- Mobile App available for iOS and Android

- Can create different account levels and API access permissions (Administrator, Manager, Trader, Auditor)

Despite being on the high side of fees, Gemini does a great job when it comes to deposits and withdrawals. In addition, trading fees decrease the more your trade within a 30-day period. Starting from 0.25% for under 1,000 BTCs to 0% when your total monthly trading volume reaches 5,000 BTCs or 100,000 ETH.

Gemini Seems to be the best fit for larger institutions or for the lack of a better term, crypto whales. Being headquartered in the United States, and their strong commitment to regulatory compliance makes Gemini one of the safest cryptocurrency exchanges to trade on.

Binance

This exchange launched back in 2017 and quickly became one of the largest exchanges by adjusted trading volume. With more than 160 cryptocurrencies to trade and over 500 trading pairs, Binance, by far offers the largest selection. It is headquartered in Malta and works closely with the Maltese government to ensure regulatory compliance.

Pros:

+ Over 160 Cryptocurrencies

+ High liquidity

+ Mobile and Desktop apps

+ No deposit or withdrawal fees

+ Competitive fee options with BNB token

Cons:

– Limited advanced trading tools

– Shaky reputation after the recent hack

– 2 BTC daily withdrawal limit for unverified users

Fees:

| Trading: | 0.1% (25% discount for BNB holders) |

| Withdrawals: | Cryptocurrency – none, SEPA – €0.90 EUR, Wire – 0.09% |

| Deposits: | Cryptocurrency – none, SEPA – None, Wire – 0.05% |

Additional Info:

- No KYC required to start trading

- Launching a separate exchange for US citizens which will dilute liquidity

- Runs a successful IEO launchpad (initial exchange offering)

- Has a DEX (decentralized exchange)

Binance is a strong contender for being the number one Coinbase alternative. It exceeds all the other exchanges by trading volume and by the number of cryptocurrencies offered. In addition, buying BNB (the native exchange token) allows users to get a 25% trading fee discount. It is unknown, however, how long this promotion will last.

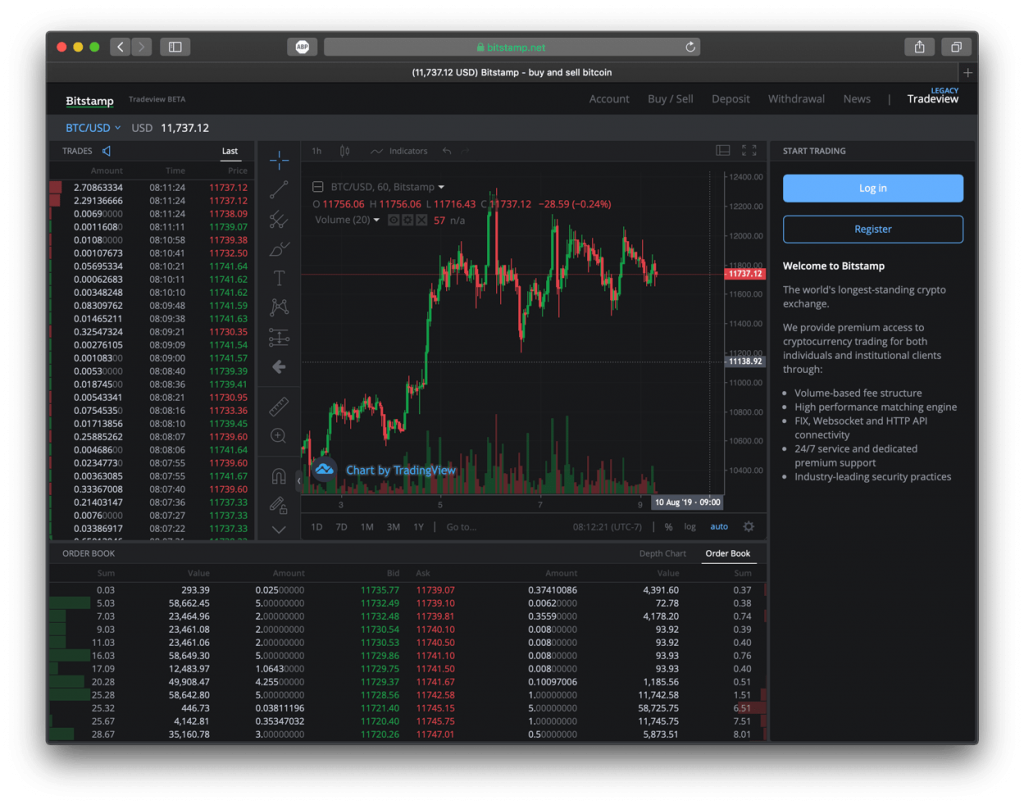

Bitstamp

This Luxembourg-based exchange has won hearts and minds since its inception in 2011. Bitstamp is considered one of the top four exchanges and is Europe’s oldest cryptocurrency exchange. The exchange trades in the following coins: Bitcoin, Ethereum, Ripple, Litecoin, and Bitcoin Cash.

Pros:

+ Low, transparent fees

+ Good reputation and strong security

+ Several fiat deposit and withdrawal methods

Cons:

– Relatively low 30-day volume

– Limited markets (EU focused)

– No margin trading

– A limited list of cryptocurrencies (5 total)

Fees:

| Trading: | .25% for low volume, down to .10% for high volume |

| Withdrawals: | Cryptocurrency – none, SEPA – €0.9, Wire – .09%, Debit card – $10 under $1000 and 2% for amounts over $1000 |

| Deposits: | Cryptocurrency – none, SEPA – none, Wire – .05%+, Debit card – 5%+ |

Additional Info:

- Fiat withdrawals take around 2-3 business days

- Average response time for support tickets is 24-72 hours.

- You can fund your account via wire-transfer or a credit card.

- Mobile app is available for iOS and Android devices.

While not perfect, given its limited market reach, low volume, and list of only 14 crypto pairs, this is still a strong alternative to Coinbase. Particularly because of its relatively low fees, and most notably, free cryptocurrency deposits and withdrawals. Meaning that you can send your crypto here to test out the platform without incurring any costs.

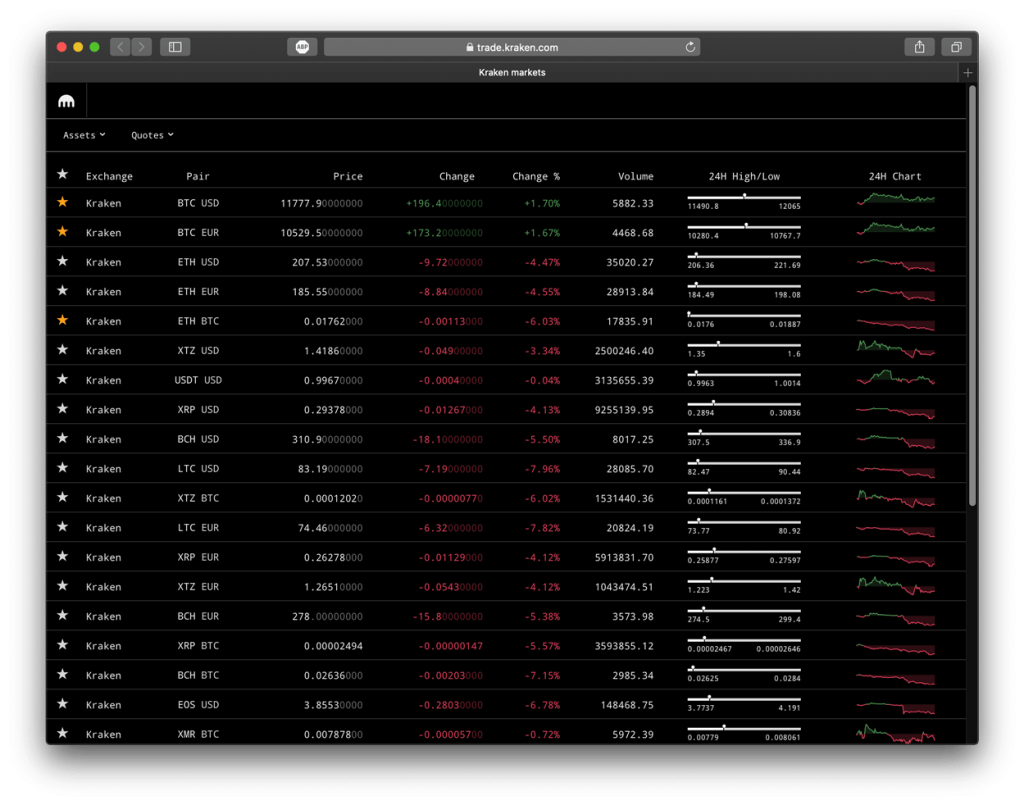

Kraken

Another of the oldest and most recognizable exchanges, Kraken was created in 2011 and has continued to grow through funding the past eight years. This exchange trades in the major coins and a slew of other minor coins.

Pros:

+ Perfect security record

+ Serves over 200 countries

+ Margin trading up to 5x

+ Good for trading altcoins (20 cryptos total)

Cons:

– No mobile app

– Complicated fees structure

– Does not support credit card crypto purchases (not that it’s a good idea to do so)

Fees:

| Trading: | Maker 0% to .16%; Taker .10% to .26% (changes depending on volume) |

| Withdrawals: | Cryptocurrency – variable, SEPA – €0.9, Wire/ACH – $5 |

| Deposits: | Cryptocurrency – variable, SEPA – none, Wire/ACH – $5 |

Additional Info:

- Advanced charting & trading tools are available on Kraken Pro.

- Can fund account with 5 different fiat currencies (USD, GPB, JPY, EUR, CAD)

- No KYC for the Starter tier

Depending on your geographical location and charting tool requirements, trading on Kraken might be best suited for you.

BitMEX

BitMEX is one of the first exchanges to offer margin trading for Bitcoin. Launching back in 2014, the exchange now offers 9 different cryptocurrencies to pick from. Users can only margin trade on BitMEX, meaning that you cannot buy Bitcoin directly from their platform. In order to deposit funds, you’ll need to first use a fiat to crypto exchange, then transfer your Bitcoin to your BitMEX account.

Pros:

+ Up to 100x leverage

+ High liquidity

+ Advanced trading tools and charts

+ Supports anonymity

Cons:

– Platform sometimes overloads

– Restricted for US users

– Difficult user-interface to learn

Fees:

| Trading: | Maker .025%; Taker .075% Settlement: .05% |

| Withdrawals: | None |

| Deposits: | None |

Additional Info:

- No KYC required

- US restriction can be bypassed by VPN (we do not condone users to attempt this)

- Contracts do not expire

Although BitMEX and Coinbase are targeted towards different types of users, it is worth exploring whether BitMEX is the right exchange for you. users who are looking to trade cryptocurrencies with leveraged positions should look no further. With a whopping 100x leverage on Bitcoin and up to 50x on Ethereum, BitMEX is the best choice for high-risk traders and degenerate gamblers.

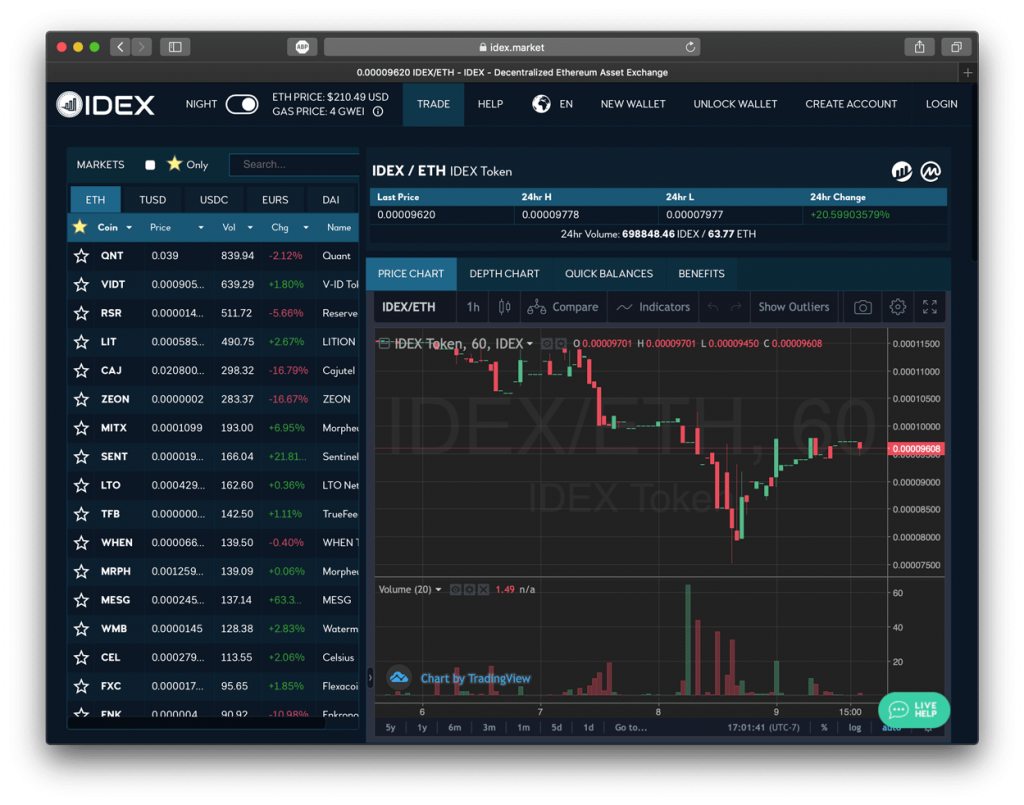

Bonus: Coinbase DEX Alternative

A decentralized exchange (DEX) is a type os cryptocurrency exchange where buyers and sellers exchange cryptos directly, without a third-party acting as an escrow and holding the coins being traded. This peer to peer protocol empowers users by eliminating the need for a middle man to control your private keys. As the saying goes, “not your keys, not your crypto”.

IDEX

As of today (08/09/2019), 56% of all DEX transactions occur on IDEX. This makes this decentralized exchange a clear market leader. The runner up in terms of trading transactions is Kyber Network with 12% market share. IDEX utilizes Ethereum smart contracts and support stop and limit orders.

Pros:

+ Most liquid DEX

+ Competitive fees

+ Available worldwide

+ Supports anonymity

+ Over 400 cryptocurrencies pairs

Cons:

– Only ERC-20 tokens

– Crypto deposits only

– ETH-based trading pairs

– Low volume compared to centralized exchanges

Fees:

| Trading: | Maker 0.10%, Taker 0.20%+ gas fees |

| Minimum order limits: | Maker $20, Taker $10 |

Additional Info:

- Allows users to cancel trades without wasting gas

- Can trade directly from ledger wallets

- Withdrawals of up to $5,000 USD per day for unverified users

With exchange hacks becoming commonplace, users should start taking into consideration DEXs as alternative options. If we buy and sell decentralized cryptocurrencies, why are we not doing so on decentralized exchanges?

Overall: What Is the Best Coinbase Replacement?

Binance!

Binance is without a doubt the top contender for Coinbase. Users globally agree with this conclusion as the exchange is number one in terms of verified trading volume. With more than 160 cryptocurrencies and over 500 trading pairs, it should scratch all your crypto itches.

Even though the exchange recently suffered from a hack resulting in 7,000 Bitcoins stolen, Binance refunded all their users and promised to increase their security measures. They are also working on building their own decentralized exchange to compete with IDEX, and recently started offering leverage trading options to compete with BitMEX.

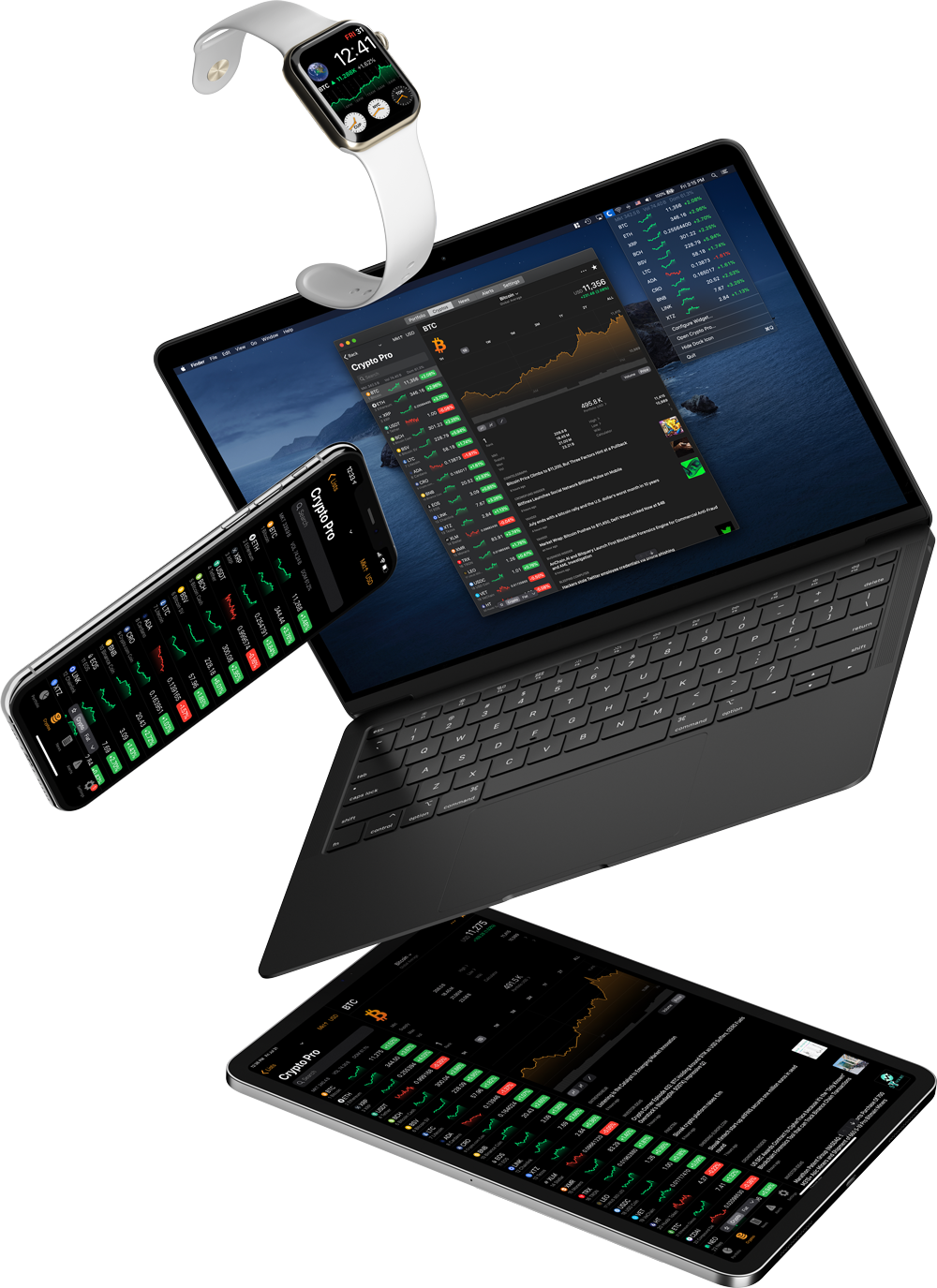

Track Your Crypto Portfolio

Whichever exchange you decide on, you’ll be able to track your investments with Crypto Pro – The all-in-one cryptocurrency tracker. Our API import feature allows you to connect to 60+ exchanges and automatically pull in your balances and populate your portfolio(s).

Stay in Touch

We like to keep in touch with like-minded people. You can follow us on Twitter, join our Telegram Group, like us on Facebook, and even send us an email at [email protected] if you need assistance or have a suggestion in mind.