Facebook recently announced the launch of Libra in 2020. In this article, we compare Libra to Bitcoin and other cryptocurrencies, based on four main parameters: use of the blockchain, decentralization, rationale for creation and regulatory frameworks. This would provide a better analysis of how a user can choose to use either or both.

Blockchain and Consensus Mechanisms

The biggest debate on Libra is whether it uses blockchain technology in the same manner as other cryptocurrencies. Bitcoin uses Proof of Work (PoW) consensus mechanism, which dictates how the network functions and the rules for verifying transactions. Proof of work is designed to allow miners to compete in solving complex mathematical equations, with the winner gets rewarded in Bitcoin. Blocks link verified transaction together, making them difficult to change. The more transactions there are, the stronger the network becomes, making it less prone to an attack. An attacker will need to go back in time and literally change all previous transactions (51% attack).

This concept of batching transactions together is known as Merkel Tree. Hundreds of other cryptocurrencies use this concept to store their data and ensure strong network security. Furthermore, anyone can verify the data on a public ledger, hence the concept of permission-less blockchain. This property enables higher security levels and decentralization, but compromises on transactions verification speed which, in the case of Bitcoin is relatively slow.

Facebook’s Libra Coin also uses a blockchain for storing transactions, but in a different way than Bitcoin and other cryptocurrencies. Verified transactions are stored sequentially as opposed to linking them together. This is known as the consensus protocol is called Byzantine Fault Tolerance (BFT). It enables the system to continue operating even when some nodes fail. This optimizes for faster transaction verifications. However, the network is a Permissioned Blockchain, meaning it is not public and not everyone can see and verify transactions other than authorized parties.

Decentralization vs Centralization

Another main point of comparison is decentralization. Minors and communities support Bitcoin’s fully decentralized blockchain. It does not rely on fundraisings, committees or a single company to run it. Miners can join or leave the network whenever they please. And individuals can host nodes on their computers to keep track of the transactions. Miners receive an incentive in Bitcoin every time they verify a transaction.

On the other hand, a consortium of 27 corporations manages Libra. This number will rise to 100 when the project launches in 2020. Any corporation that wants to join must pay $10M to act as a node and verify transactions in the network. Meaning that Libra Coin is not decentralized like Bitcoin or other cryptocurrencies.

Tradable Digital Asset vs Stablecoin

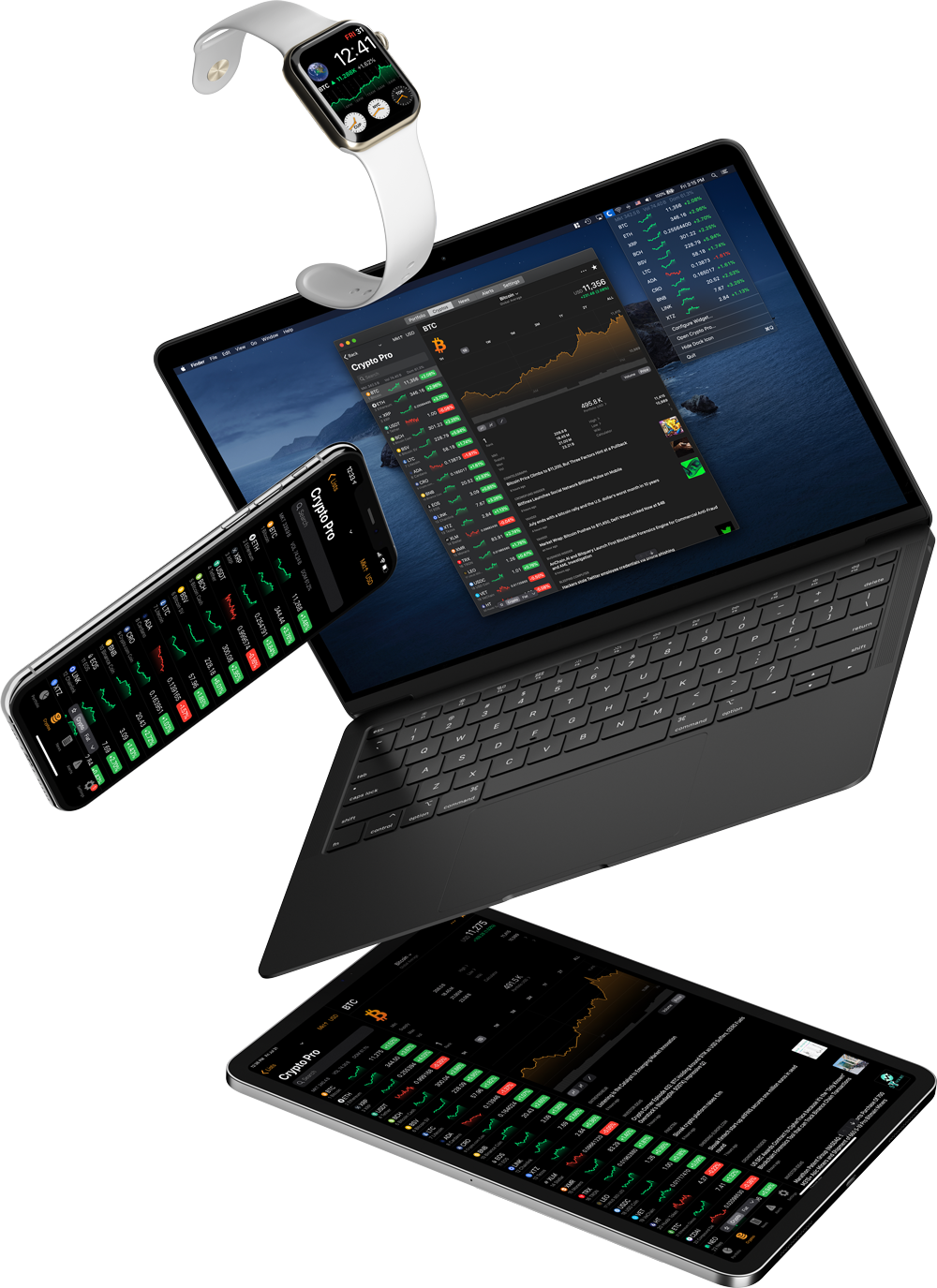

Bitcoin and other top cryptocurrencies have a fixed token supply. For Bitcoin, the token supply limit is only 21 million Bitcoins, while for Ethereum is 100 million. Bitcoin’s supply limit introduces the idea of a deflationary currency model.

Supply and demand dynamics determine the price of a cryptocurrency. This has caused the price to severely fluctuate over the last 10 years since its inception. For example, the price of Bitcoin has gained over 250% in 2019 alone, moving from lows of about $3200 to $11,000 at the time of writing. Etherium swung from $1,400 in 2018 to $85 in 2019, and now is traded for around $300. This fluctuation in price attracts traders and speculators. With the value of Bitcoin and other cryptocurrencies stemming partially from their decentralized network. As more people use the network, it becomes stronger and valuable as a way of exchanging and storing value (hence seen as a digital gold).

This fluctuation in price attracts traders and speculators. And with the value of Bitcoin and other cryptocurrencies stemming partially from their decentralized networks. As more people use the network, it becomes stronger and valuable as a way of exchanging and storing value (hence seen as a digital gold).

On the other hand, Libra Coin is a stablecoin. A stablecoin is a type of cryptocurrency that maintains value and is not volatile. The price is pegged to a basket of low volatility assets, such as government bonds and fiat currencies (USD, Euro, and Yen among others). Thus, Libra Coin is not a “tradable” digital asset, but rather as a medium of exchange between parties at a global scale. Facebook created Libra reserve to back the Libra Coin. The Libra reserve dictates the direction and management of Libra Coin.

Legal Status

Satoshi Nakamoto created Bitcoin during the financial bubble of 2008-9 and it serves as an alternative to the current central banking system. This means that it is not subject to one central bank or national government’s control. Even if a country bans trading and mining of Bitcoin, the network continues to run. Anyone can start using Bitcoin without a registration or user identification process. Exception being when trading on centralized exchanges.

Governments and companies will regulate Libra Coin. Therefore, obtaining money remittance licenses is necessary. Subsequently, users of Libra will need to undergo a rigorous identification process (Know Your Customer, KYC). Soon after the project announcement, lawmakers in the USA and Europe raised concerns about the potential of Libra Coin in challenging existing national currencies and called for stricter regulation.

Conclusion

Bitcoin and other cryptocurrencies have some similarities in terms of adopting blockchain technology but have stark differences in creation rationale and usage. It is, therefore, possible that both will be able to exist to serve different functions in the digital economy.

Stay in Touch

We like to keep in touch with like-minded people. You can follow us on Twitter, join our Telegram Group, like us on Facebook, and even send us an email at [email protected] if you need assistance or have a suggestion in mind.