An overview on how Binance became the number one exchange

In an industry that’s had so many failures, including exchanges getting hacked and companies growing fast only to have massive layoffs, a successful crypto company exchange is sort of a unicorn. Binance has emerged from seemingly out of nowhere to become the number one exchange in terms of trading volume in just two years, averaging trades of over $2 billion USD per day.

How did that happen, and what makes this exchange different enough from others to not just survive but thrive in the ever-changing crypto market? We’ll delve into the rise of Binance in this post and look into its recent hacking controversies.

History of Binance

We don’t have to go very far back in time to uncover Binance’s history. It launched in 2017 and is led by CEO Changpeng Zhao, who claims “luck” as one of the reasons for his company’s massive success. But it’s more likely that Zhao’s previous experience combined with some common sense approaches to things like hackers and becoming an integral part of the cryptocurrency community helped along the way.

Binance might have come from nowhere, but its CEO didn’t. Zhao’s background is in building software for brokers and exchanges. He started working in blockchain in 2013 when he worked for the wallet app blockhain.io. He later co-founded OkCoin, which was a Chinese exchange. He raised $15 million in 2017 to start the crypto-to-crypto exchange Binance.

All of these experiences helped Zhao learn what did and didn’t work in the cryptocurrency space. He also gained a deep understanding of the market and was able to deliver what he knew crypto customers needed that they weren’t getting from other exchanges—an exchange that put them and their investments above everything else.

How Binance Operates

Binance operates according to federal regulations and is available in all but 15 countries. The main thing that separates it from other exchanges is simple, really. It values its users and puts users ahead of everything else, no matter what happens.

For instance, shortly after Binance launched, the Chinese government decided to shut down all exchanges. They changed regulation policies and demanded that all Initial Coin Offering (ICO) exchanges return funds to investors. Zhao went a step beyond what the government was asking by refunding all Binance users their original assets at the original investment rate.

This commitment to protecting users’ investments helped Binance gain an extremely loyal following from members of the crypto community, regardless of whether they were directly impacted by the change in Chinese regulations.

How It Was Different from the Start

Binance’s CEO clearly has more than luck to thank for his company’s success. First, he initially designed the exchange to not allow trading in fiat currencies. This allowed the company to get around regulation issues that come with using government currencies.

Next, he was able to put together a team that was able to successfully supply the infrastructure Binance needed to serve the market demand. This allowed Binance to add new crypto markets efficiently and led to their ability to scale to three million users in the first six months of launch.

Finally, the commitment to customer service by putting users first is something that the crypto market was missing and, clearly, desperately wanting.

Despite Hack Attempts, Funds Are Safu

Like other exchanges, Binance is a big target for hackers who want to make off with millions of dollars’ worth of cryptocurrency from just one hack. In March 2018, hackers attempted a large-scale attack that took just under two minutes. Binance, fortunately, had systems in place to prevent hackers from being successful. Their risk management system disabled the attempted withdrawals and froze the VIA coins that the hackers had deposited. No money was ever taken out.

Following the March 2018 attempted hack, Binance announced something new and appealing to the crypto community: a hacker bounty program. The company offered a $250,000 reward to the first person who gave them information that led to the legal arrest of the hackers. Furthermore, the company has set aside $10 million USD for future hacker bounties.

In some ways, this hacking attempt is what pushed Binance to the top of the crypto exchange food chain. But it wasn’t enough to prevent future attacks from happening.

In May 2019, Binance was hacked again, and this time the hackers succeeded in stealing $40 million worth of cryptocurrency. The CEO was fairly transparent in a blog post he wrote that detailed the circumstances surrounding the attack, stating that, even though alarms were triggered as soon as the hackers made their withdrawal and further withdrawals were immediately disabled, “The transaction is structured in a way that passed our existing security checks.”

Binance dealt with the hack by swallowing the costs instead of offloading the expense to their users. The company has a Secure Asset Fund for Users for just such an occasion. In an unprecedented move, the exchange remained open, and investors were able to continue trading, if they wished.

In August 2019 a hacker released 10,000 Know Your Customer (KYC profiles) of Binance users, all supposedly related to the May 2019 hack. The leak apparently could affect as many as 60,000 users who submitted KYC information to Binance in 2018 and 2019.

According to a Binance blog post, an unidentified person has threatened the company and “demanded 300 BTC in exchange for withholding 10,000 photos that bear similarity to Binance KYC data.” Binance is still investigating and believes there are inconsistencies in the story the hacker is telling and the information he or she actually has. It is still unclear whether the KYC data was actually stolen from Binance or faked to look as such.

Binance advises all customers to be wary of anyone attempting to impersonate a Binance customer service official by asking customers to withdraw funds. They are also offering a reward of 25 BTC for anyone who can deliver enough information to lead investigators to identify the hacker. We’ll have to wait and see how the KYC controversy unfolds and whether it will have any effect on Binance.

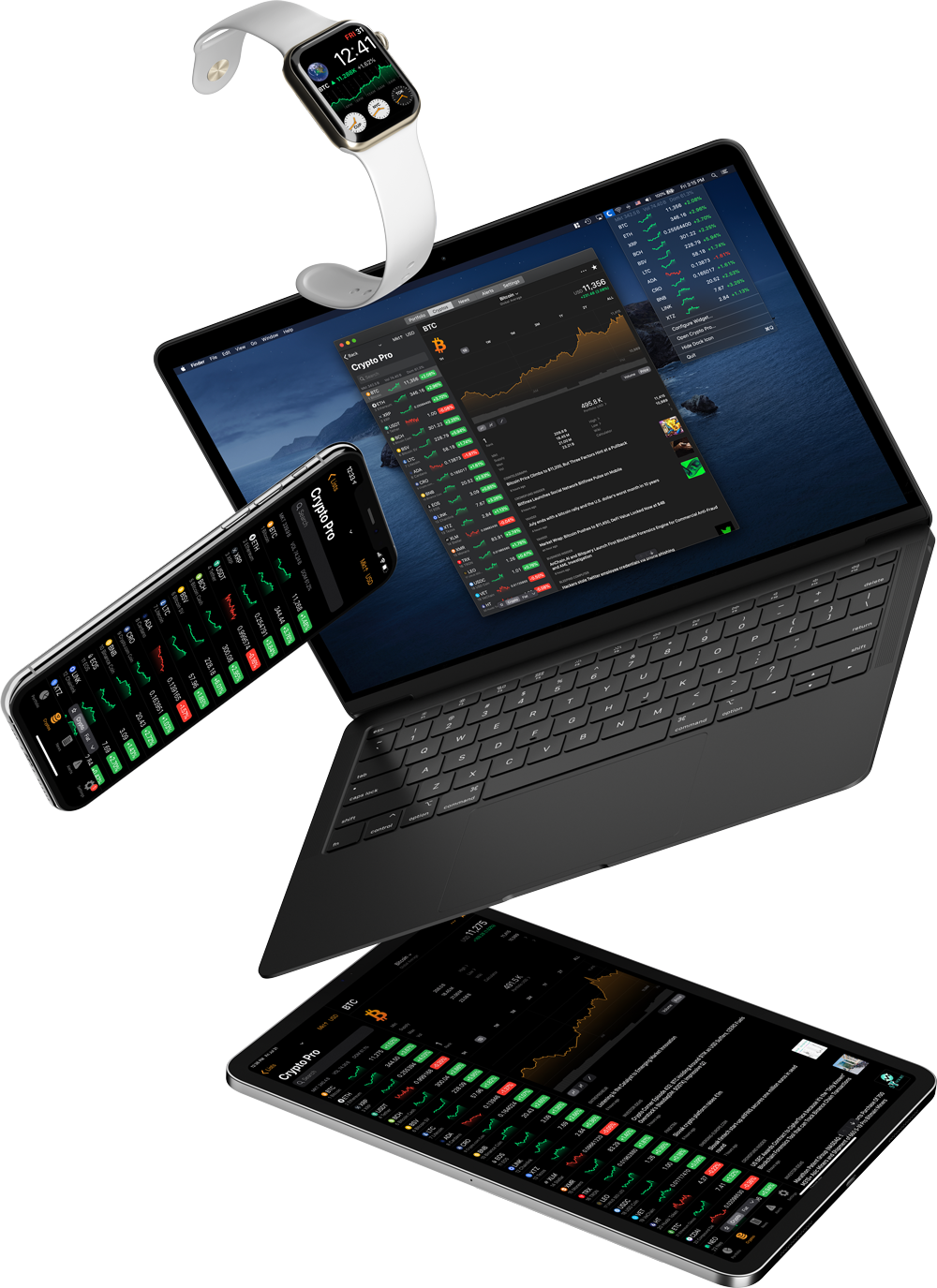

Track Your Portfolio with Crypto Pro App

If you’re currently on the Binance exchange, or if you’re interested in trying it out, remember that Crypto Pro offers a portfolio to exchange sync feature. Our app can pull your balances and automatically display them in one of your portfolios. To learn how to sync your portfolio with Binance, check out our Binance API guide.

Crypto Pro — The all-in-one cryptocurrency tracker. Download it from your App Store today.