An Overview of 5 Different Methods You Can Use to Short BTC

This content is for informational purposes only, you should not construe any such information as legal, tax, investment, financial, or other advice.

Shorting represents a fairly-popular trading strategy that is commonly used by both small-scale and large-scale investors, as an alternative to long selling. It’s often referred to as a highly-speculative means of trading, granted that it involves selling that which you do not possess at a different price.

To put this into perspective, short selling represents a strategy that investors leverage in order to speculate and earn a profit when the price of stock decreases. Trading market beginners often stray away from this strategy, due to the fact that it comprises a higher degree of risk while requiring a good understanding of financial trading mechanisms. However, learning how to short sell isn’t too difficult, but it does, in fact, require the ability to cope with extra risk.

This article is bound to serve as a knowledge base for cryptocurrency users that are interested in the concept of Bitcoin shorting – a highly-profitable, yet risky trading strategy. Consequently, the main topics that will be covered include, but are not limited to a summary of shorting as a trading mechanism, an introduction to BTC shorting, a look at the best methods of shorting the cryptocurrency, and lastly, an overview of proficient risk management when short-selling crypto-based assets.

How does short-selling work?

The process is fairly simple to grasp. Thus, traders carry out a general market analysis and pick out stocks/assets/cryptocurrencies that may decrease in price by a future date, commonly referred to as an expiration date. Then, the said investor goes ahead and ‘shorts’ the market, by borrowing a specific number of shares. These shares are then sold to other traders at the moment’s price. Later on, as the expiration date gets closer, the trader must purchase the same stock at the newer price, in order to return the asset. The profit is made up by the price difference present between two moments – when the stock was borrowed and when it was re-purchased following its sale to a third party.

With this in mind, the risk consists in whether the shorted asset grows in price or loses some of its value. If the value drop isn’t what the trader expected, then the difference must be paid out of one’s own pocket.

The practice of shorting Bitcoin

The last couple of years have shown us that while cryptocurrencies hold great potential in revolutionizing the current financial market status quo, they’re at a point in their existence characterized by high-volatility rates, especially in times of change. Thus, the Bitcoin market has seen significant value records, followed by shocking price dips. This has contributed to significant daily trading volumes. For instance, at press time, BTC holds a $15.6 billion 24h volume, alongside a $169.85 billion market capitalization.

Accordingly, it only makes sense that numerous investors, traders, and general digital currency users are interested in short-selling our favorite cryptocurrency. Indeed, shorting Bitcoin is associated with high risk, but such speculation is bound to provide users with significant profits.

The next section of the article will be focused on listing and analyzing the main approaches to shorting Bitcoin.

Methods of shorting Bitcoin (BTC)

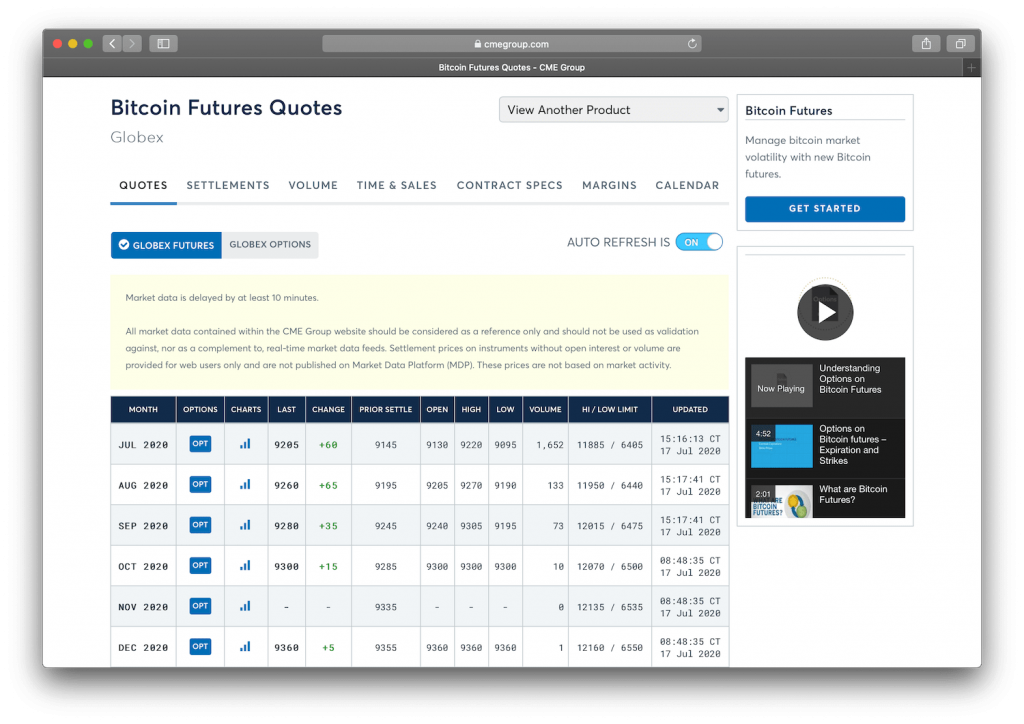

1. Futures trading

Cryptocurrency futures trading has become quite popular over the last few years, as numerous traders are keen on speculating upcoming prices. Thus, the basis of this investment mechanism is that buyers choose to purchase a security, via a specific contract, which includes relevant data on the purchase price, sale price, and the expiry date. When buying a futures price, investors generally believe that the price of the specific asset will increase before the contract is sold at its expiry date. Similarly, when selling a futures contract, traders are expecting a price dip, which will provide speculator profits in consequence.

This is the case with Contracts for Differences (CFDs), which are defined as a contractual agreement to exchange the price difference between the open and close position for that specific contract. Thanks to leverage, full market exposure can be attained through an initial margin deposit.

Currently, there are several Bitcoin futures marketplaces that users can refer to. This method of shorting Bitcoin is well-regulated by the Commodity Futures Trading Commission in the United States, thus giving investors an increased degree of trust over services (such as CME), that provide futures trading. Generally, futures are contracts listed for 6 consecutive months, yet expiry rates depend on your provider of choice. Last but not least, it is important to keep in mind that in the case of shorting BTC via futures trading, no actual digital currency is exchanged. Rather, a contract purchase is speculation over the price a specific asset will have after a predetermined period of time.

Popular platforms:

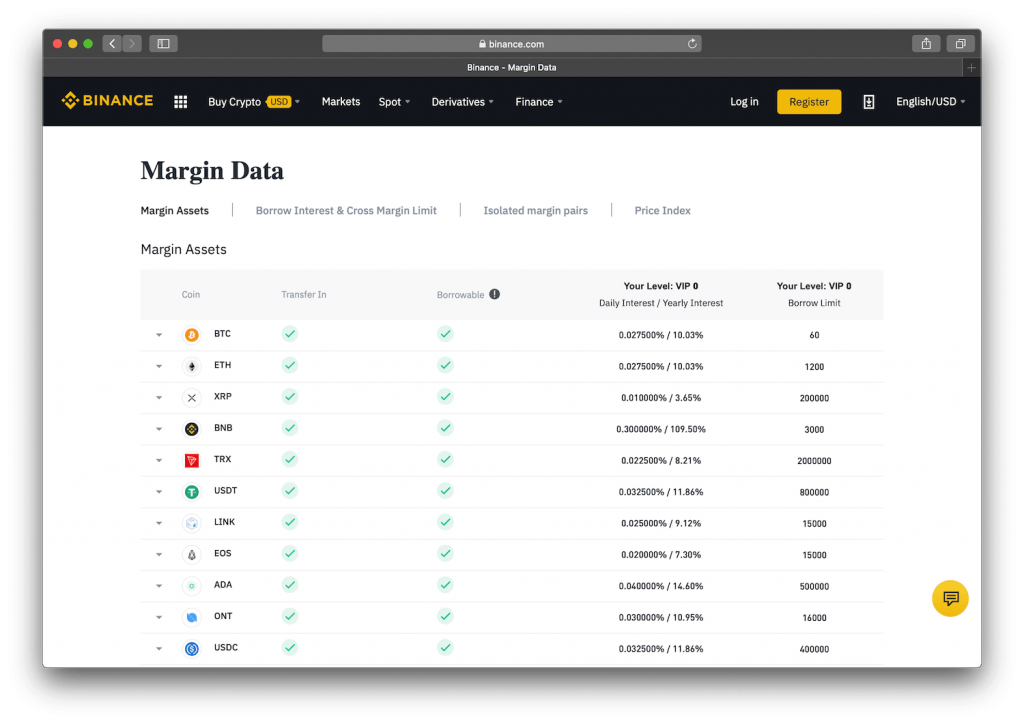

2. Margin trading

This is likely one of the most popular methods of shorting cryptocurrencies. Margin trading platforms are easy to find, given the fact that most high-volume exchanges offer this type of service.

The idea behind margin trading is easy to conceptualize. Buyers are given the ability to theoretically borrow a specific amount of capital from a broker, for the purpose of making trades that they wouldn’t normally be able to afford. There is a specific degree of risk at play here, given the fact that buyers must return their debt, while the difference is kept as profit. Thus, if the trade succeeds, the borrowed amount is easily returnable and the profit is pocketed. If the trade fails, buyers may have to resort to paying the outstanding balance out of their own pockets. Moreover, many exchanges that offer margin trading also provide users with leverage, which is a method of further increasing potential profits/losses. The leverage factor is generally recommended for experienced traders, who can better gauge potential risks.

Popular platforms:

3. Shorting via binary options

This method is certainly less frequent when compared to some of the alternatives listed in this article, but nevertheless, it offers similar results. As such, several binary option trading platforms also allow for BTC shorting. The procedure is a bit more complex, as it involves executing a put order via an escrow service. Basically, the main idea for investors is to sell the currency at its initial price, despite a potential dip later down the line. The legality of binary options trading is quite grey in the US and several other countries, but there are still plenty of jurisdictions that allow the use of this instrument.

Popular platforms:

4. Short-selling the traditional way

The process is a bit complex as users must first borrow Bitcoin at the current market price from a broker, credit platform, or individual third party. Then, the borrowed coin is sold. If the price decreases, the coin is re-purchased at a better price, and then returned to its original owner, thus profiting the shorter in case the market moves in their favor. However, it is becoming increasingly difficult to carry out short-selling traditionally, given the fact that numerous brokers and other third parties are unwilling to borrow coins for this purpose, given the high risks.

Of course, one could also sell their own tokens at a specific price, wait for a drop, and then repurchase the said tokens. This is basic short trading, and remains very popular at this moment. However, the downside is that users must use their personal coins to hedge, while keeping a close focus on market movements, to ensure that buy and sell orders are placed at the right time.

Popular platforms:

5. Betting via prediction markets

Last but not least, this is a BTC short-selling method that is gaining a certain degree of popularity. The concept behind this strategy is fairly simple – users rely on betting platforms, where they start a bet concerning the future price of Bitcoin at a specific date. Other users can wager based on their predicted outcome, so if another person takes on the bet, a profit can be achieved if your initial forecast proves accurate.

Popular platforms:

Risk assessment

As highlighted during this article, there are numerous benefits to shorting Bitcoin, given the fact that the practice allows you to profit from decreasing prices without too much difficulty. However, there are numerous experts that advise against short selling, due to the inherent possibility for unlimited losses. Indeed, traditional shorting mechanisms warrant extra care, since a cryptocurrency like bitcoin can undergo huge price swings overnight. Thus, a shorting contract started today may lead to huge losses in case the price increases.

Furthermore, the market is still in an early stage, therefore while seemingly stable, prices can change considerably. Thus, traders who engage in shorting bitcoin, or any other stock or asset, must be aware of the risks associated with this practice. Therefore, traders must personally weigh the advantages and disadvantages. Luckily, risk can be reduced by shorting lower amounts. Nevertheless, the cryptocurrency market has proven fairly stable within the last couple of months, as no massive price swings have occurred.

Bottom line

Based on everything that has been highlighted in this article, those who wish to speculate over the price of bitcoin might want to consider whether shorting is for them. The practice offers a high-risk high-reward ratio, that’s definitely worth taking into consideration.

There are plenty of methods that can be successfully leveraged to carry out this practice, some of which are brand new, whereas others are more traditional.