An analysis on Bitcoin Halving and how it’s affect on the market

One of the main factors that distinguish bitcoin from fiat currency is the fact that it’s limited. Only 21 million bitcoins will ever be distributed, which makes it a scarce commodity.

This scarcity has led to developments designed to limit the amount of bitcoin that miners can get as a result of solving complicated bitcoin transactions. In particular, halving is in place to cut down the amount of bitcoin a miner will receive every time they add a block to the blockchain.

About every 10 minutes, miners solve a block of bitcoin transactions. As a reward, miners receive a “block award” in the form of bitcoin (BTC). When bitcoin was first introduced in 2009, the reward was 50 BTC. Today, the reward is only 12.5 BTC. What happened?

In short, halving happened. The block reward was cut in half once, and then it was cut in half again. Halving is a feature that’s programmed into bitcoin to cut the amount of block reward in half roughly every four years (or every 210,000 blocks).

The next halving is expected to take place in spring 2020, although the exact date might change based on when the next 210,000 bitcoin will be mined. Here’s what you need to know before it happens.

What Is Bitcoin Halving?

The amount of bitcoin that a miner receives as a block reward for solving a complicated calculation that adds bitcoin to the blockchain gets cut in half about every four years. That means that, as bitcoin becomes more valuable as a resource and more scarce as a commodity, miners are going to receive less of it as a reward as time goes on. However, as the price of bitcoin rises, miners can end up getting more value out of their block reward.

In theory, halving should keep enough bitcoin available until 2140, although estimates suggest that 98 percent of all bitcoin will be mined by 2030.

When Does Bitcoin Halving Happen?

Bitcoin halving occurs roughly every four years or every 210,000 blocks. It’s important to note that the number of blocks is what dictates exactly when bitcoin halving will happen. The first halving happened at block 210,000. The second one happened at block 420,000. The next halving event will occur when block 630,000 is added. The 2024 halving event will occur on block 840,000, and so on.

The first time that bitcoin halving occurred, the block reward was reduced from 50 BTC down to 25 BTC. This took place in November of 2012. In 2016, the reward was halved again to 12.5, which is where it currently stands. In 2020, bitcoin halving will once again reduce the amount of BTC a miner receives, down to 6.25. There are several halving clocks out there online that track the number of blocks that get added to the blockchain every day. In general, experts predict that the next halving event will occur sometime between March and June 2020.

How Does the Halving Impact BTC’s Pricing?

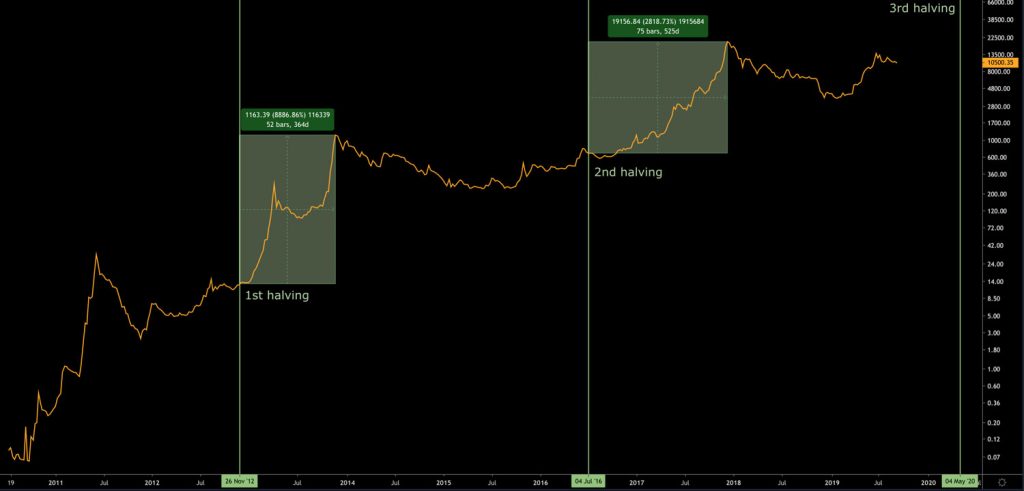

Block reward halving has historically led to positive effects on bitcoin’s price over the long-term. One reason for this is the simple law of supply and demand; as the amount of available bitcoins decreases, the commodity becomes more valuable.

The previous two halving events resulted in extreme volatility in the bitcoin market. After the 2012 halving event, the value of 1 BTC increased by 8,000 percent within a year. After the 2016 event, the value of 1 BTC rose by 2,800 percent in about a year an a half.

Note that it took nearly 1.5x as long for the price of bitcoin to reach its peak after the second halving as it did after the first. Is this an indication that it will take even longer for bitcoin to reach a new high price after the next halving? It’s hard to say at this point.

There certainly seems to be a connection between a halving event and the increased price of bitcoin. It’s important to remember that other factors are in play that can determine the price of bitcoin at any given time on the market. Investors should exercise as much caution approaching a halving event as they would during any other time to protect their investment and make sound decisions.

How Do Miners React to Bitcoin Halving?

We have to consider the role of miners when we talk about how halving impacts the price of bitcoin. After all, miners are directly impacted by receiving fewer BTCs as a result of their efforts after a halving event.

Some miners give up altogether when the halving happens. But these are only a few miners. Most miners will continue mining, understanding that the value of the BTCs they receive as a reward will be higher as a result of the halving. In order to make it worth their effort, they’ll simply refuse to sell their BTC for a lower price point. This will, therefore, drive up the price of bitcoin and make their role as a miner more lucrative and rewarding overall, even if they’re receiving fewer BTC as a reward.

What to Expect During the 2020 Halving

If history is any indication, expect to see volatility events within about 12 to 18 months after the halving occurs. However, because bitcoin is still a relatively new currency on the market, it’s hard to say with any certainty exactly what will happen. During the first halving, nobody knew what to expect. During the second one, there were other, newer, cryptocurrencies on the market that may have factored into bitcoin’s volatility.

At the timing of the third halving, it’s safe to say that more institutional investors will be taking notice than they had during the previous two halving events, which could dramatically change the outcome of the event. In any case, there seems to be a clear correlation between halving and price volatility, so bitcoin investors need to be aware of upcoming volatility in the market.

Keep up with the price of bitcoin by tracking it safely and securely on the Crypto Pro — the most private crypto portfolio tracker.