A comprehensive review of the top cryptocurrency trading bots

Between other investments and day-to-day responsibilities, most investors with Bitcoin and crypto exposure do not have the time to leverage active trading strategies. And once you factor in tax regulations and the intricacies of exchanges, many are hesitant to try and trade cryptocurrencies at all.

That’s an issue: by simply “HODLing” crypto assets, one is missing out on the potential profits that can be made by trading. Better yet, the profits that one can make through trading can be largely passive income if proper automation strategies are utilized.

Enter trading bots. Trading bots are automated software that connect to exchanges, trade cryptocurrency with an intended strategy, and can handle the advanced logistics of flipping cryptocurrencies for their users. Compared to trading cryptocurrencies, using a trading bot may be seen as relatively easy.

Bots come in both free and paid variants, and each service provides different features and benefits. But before we get into the details and review of each bot, first, a primer on the age-old argument of HODLing vs. trading and a brief discussion about trading bots.

HODLing vs. Trading

To many, Bitcoin investing is as simple as “setting it and forgetting it.” Regularly depositing BTC into a cold wallet solution and checking in on it once in a while has become commonplace for many crypto investors. Yet in doing so, one misses out on the day-to-day volatility of the cryptocurrency market.

Good traders know how to capture value trading swings in the value of crypto assets, whether that’s buying altcoins before they rally against Bitcoin, opening a leveraged long or short position on margin, arbitraging markets, hedging futures positions with options, or a handful of other strategies.

Some of the best traders are able to outperform the underlying Bitcoin price by hundreds of percent by leveraging different strategies. Of course, not everyone who trades is guaranteed to succeed, but there’s an opportunity in trading that many try and capture in different ways.

What is a Trading Bot?

A trading bot or an automated trading system is a software that buys and sells assets in accordance with preset strategies. As Investopedia explains, automated trading systems allow traders to “establish specific rules for both trade entries and exits that, once programmed, can be automatically executed via a computer.”

Trading bots come in many forms: some simply follow basic technical signals, such as “golden crosses” in moving averages or relative strength index divergences. Others leverage custom strategies and indicators that may weigh dozens of technical signals and lean on artificial intelligence. There are also systems that are based on news flows — hence why the S&P 500 moves so fast in the wake of important policy announcements or the publishing of articles.

Basically, as long as it can be coded, you can create a trading bot for any scenario and for any asset class.

Popularity

In both traditional markets and in the cryptocurrency market, automated trading systems have seen a surge in popularity over recent decades. Investopedia, in fact, writes that 75% of all the trades on U.S. stock exchanges are executed by bots.

The world’s largest hedge fund, Bridgewater Associates, uses trading systems that are based on a set of parameters. A representative of the company told Business Insider:

“Ever since 1983 Bridgewater Associates has been creating systematic decision-making processes that are computerized. We believe that the same things happen over and over again because of logical cause/effect relationships, and that by writing one’s principles down and then computerizing them one can have the computer make high-quality decisions.”

The funds of Bridgewater Associates have also been among some of the world’s best performing at times, especially during the 2008/2009 Great Recession. That’s to say, trading bots and automated investing systems can work, it’s just a matter of how you go about it.

There are many other well-performing fund managers on Wall Street and on Main Street that leverage automated systems.

Advantages

The popularity of trading bots isn’t baseless:

- They can allow newbie and veteran traders alike to leverage trading strategies otherwise relegated to advanced market participants.

- Bots can be online 24/7 while human traders may only be actively trading for ~8 hours a day.

- Automated systems remove emotion from trading. Being overtaken by emotions is commonly quoted by prominent investors as the biggest mistake one can make when trading.

- Bots are simply faster than humans, reacting to inputs at the speed of light rather than one’s reaction time.

- They allow an investor to diversify their portfolio, as a majority of mom and pop investors only have time to focus on one asset class, whether that’s equities, bonds, crypto, or real estate. Moreover, bots have the bandwidth to watch multiple altcoins simultaneously while human traders may only be able to track Bitcoin, Ethereum, and a few other top coins.

Disadvantages

As a pertinent aside, trading bots aren’t perfect.

On May 6, 2010, the U.S. stock market saw a brutal stock market crash triggered largely by algorithms. The crash saw the Dow Jones Industrial Average lose 9% in minutes. A report from the U.S. SEC and CFTC concluded:

“The combined selling pressure from the sell algorithm, HFTs, and other traders drove the price of the E-Mini S&P 500 down approximately 3% in just four minutes from the beginning of 2:41 p.m. through the end of 2:44 p.m.”

Basically, trading bots resulted in a temporary loss of hundreds of billions of users. Yet regulations have been put in place to prevent the same scenario from happening again.

The point in bringing up this story is, like other pieces of software, whether that’s a game on your computer or Facebook, trading bots are susceptible to bugs and attacks. It’s a matter of hedging risks and using the right software for your goals.

Top Bitcoin & Crypto Trading Bots

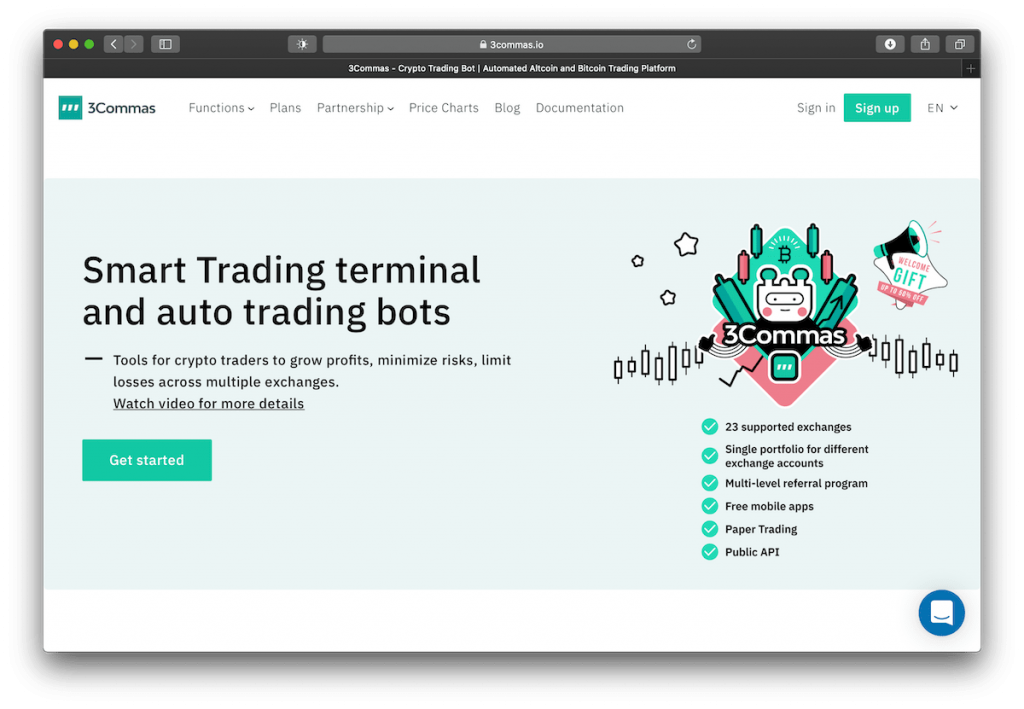

1. 3Commas

3Commas is one of the most popular smart trading platforms today. It offers tools for traders to “grow profits, minimize risks, limit losses across multiple exchanges.” This ethos has allowed the platform to see strong levels of adoption, with the company once writing it has over 70,000 users and a daily transaction volume in excess of $60 million.

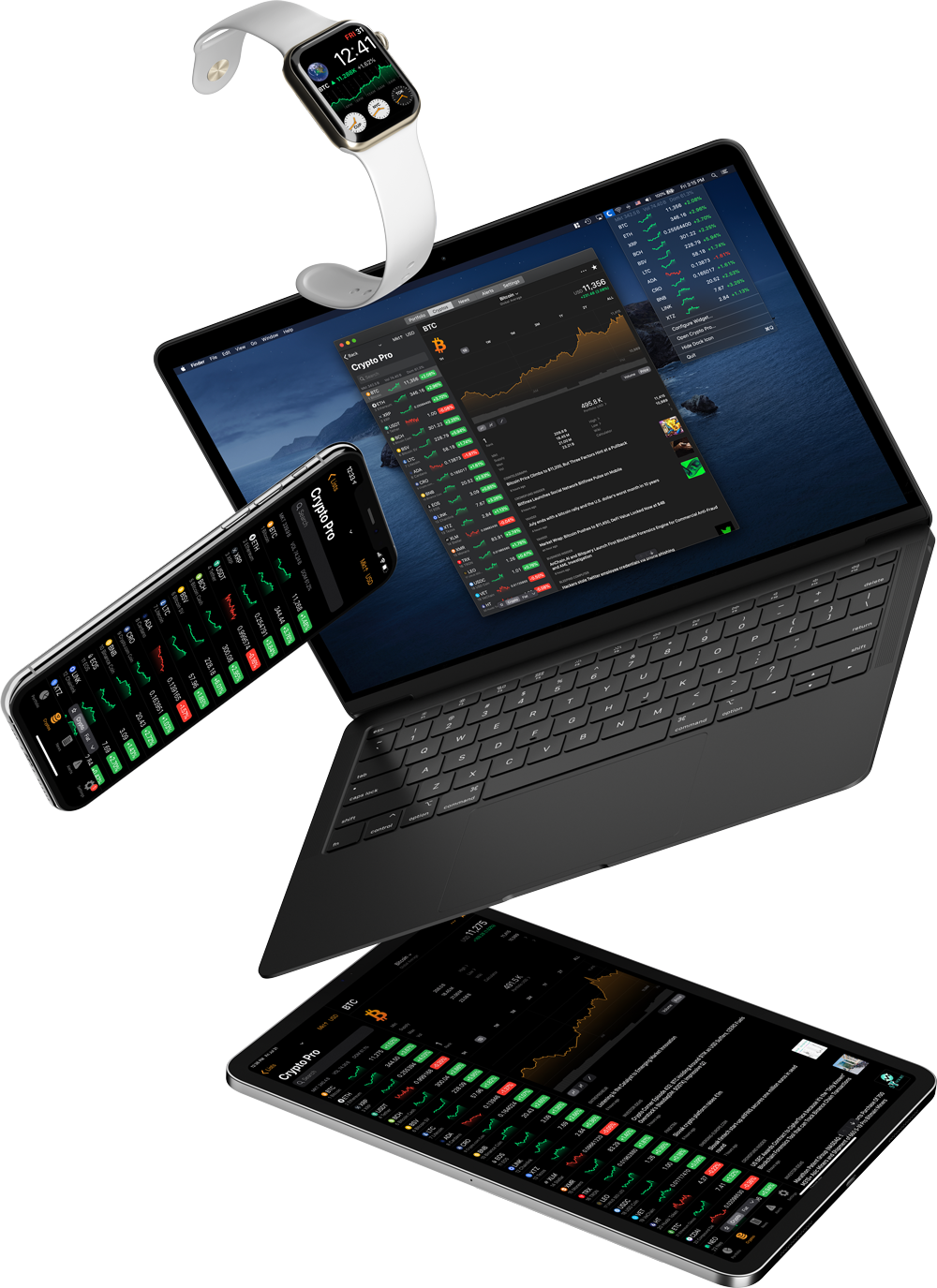

3Commas has an online platform and a free mobile app, giving traders a chance to manage and track their crypto assets on the go. The platform has one of the biggest lists of supported crypto exchanges, including recognizable names like Binance, BitMEX, Coinbase, FTX, and OKEx.

The biggest appeal of 3Commas over other platforms is arguably its “Smart Trade” functions, which allows one to manually trade while taking advantage of automated software. Some of these functions include the ability to sell your cryptocurrency at multiple prices, to have your take profit and stop loss levels automatically move alongside the market, and to “accrue additional profit with unexpected market moves.”

That’s not to say that 3Commas’ traditional trading bot features are unpopular. Far from. The platform offers many advanced features, such as native algorithms and support for custom TradingView features allowing one to see things in crypto markets that other traders cannot see. The platform also allows one to analyze and “copy” the performance of other bot settings on the 3Commas platform.

While 3Commas does not have a free package, it does offer a trial of its premium features. The platform has three levels: “Starter” at $174 per year, Advanced at $294 per year, and Pro at $594 per year. The more expensive one’s plan, the more advanced automated trading features 3Commas grants them access to.

All of 3Commas’ plans include support for 23 exchanges, a multi-level referral program, public API, portfolio aggregation for different exchange accounts, the mobile app, and a paper trading system.

2. Cryptohopper

Cryptohopper is one of the most established trading bots in the cryptocurrency space, with a large following of over 200,000 retail and professional traders that have collectively executed over 34,000,000 trades. Cryptohopper has an active support staff and FAQ system that allows one to properly use the bot. Cryptohopper is a cloud-based system, meaning you access the service via a web page.

The platform supports a swath of spot exchanges like Binance, Coinbase Pro, Kraken, and Bitfinex, yet there is currently no support for margin platforms like BitMEX or ByBit.

Along with an online platform, Cryptohopper has its own mobile application, allowing one to manage and track their portfolio on the go and stay in touch with the trading community.

Like most other trading bots, Cryptohopper supports a majority (“130+”) of the leading technical indicators and candle patterns, allowing one to formulate advanced trading strategies for up to 75 coins simultaneously.

The biggest appeal of Cryptohopper over other platforms is its bustling social scene and marketplace.

If one does not feel they have the skills to create their own automated crypto trading strategy, they can buy signals, strategies, and templates via the native marketplace. Marketplace items can cost anywhere from $0 to dozens of dollars, depends on what one is looking for.

Cryptohopper has four levels: the free “Pioneer,” “Explorer,” “Adventurer,” and “Hero.” Explorer costs $19 per month, Adventure costs $49 per month, and Hero costs $99 per month. The platform does not charge trading fees, though you will have to pay fees to exchanges as is the norm. The company accepts payments via PayPal, credit/debit cards, wire, and cryptocurrencies like Bitcoin and Monero.

How much one should pay depends on what features one wants access to. Among other features, Explorer unlocks support for backtesting via a stimulated trading bot, Adventurer unlocks the ability to easily act on arbitrage opportunities between exchanges, and Hero gives one access to advanced market-making features and Cryptohopper’s algorithm intelligence feature (currently in beta).

CryptoHopper is seemingly focused on those that want a clean user interface, want to have easy access to the trading strategies and signals of top traders, and/or want to garner fame and capital by monetizing one’s crypto trading knowledge.

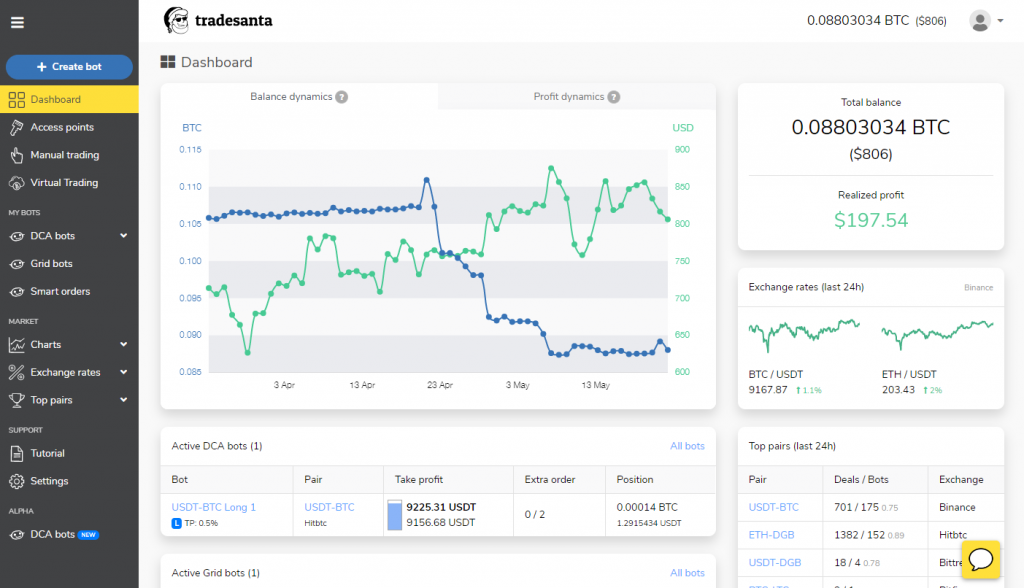

3. TradeSanta

TradeSanta is a platform that makes automated cryptocurrency trading simple. In today’s marketplace, it is the only solution that offers both free and paid tools.

The platform targets people who don’t have enough time to trade manually and want to set up a bot in under two minutes. TradeSanta supports HitBTC, Binance, Bitfinex, Huobi, Bittrex, Upbit, and more exchanges are coming.

Thanks to the long and short strategies, you can capitalize on bull and bear markets. Technical indicators will help your bots determine the right exit and entry points, and a variety of templates are flexible enough to adopt a trading strategy of your choice.

When the trading bot is set up, it will open a deal immediately or after the received signal from technical indicators.

If you utilize a trailing stop-loss feature or virtual trading to test your trading strategy, they might help you reduce financial risks. In addition to that, TradeSanta’s grid and DCA bots will place extra orders to minimize your losses.

What about security? Two-factor authentication is provided to ensure a safer account. Moreover, the platform works via API keys restricting the usage of funds by the bot on its own.

4. Gekko

Gekko is an open-source platform that allows one to automate trading strategies in the cryptocurrency market. Its code is free to access and can be viewed and altered via GitHub. The project is unfortunately not being actively maintained, with its former operator moving on to work on his own trading firm. Gekko operates with a web interface.

Importantly, the software, which can be used on Windows, Linux, and macOS, is still functional. Though, as it is no longer maintained, its viability may decrease over time, especially as more exchanges and crypto trading strategies crop up that will not be supported by the old code.

The platform can connect to 16 different exchanges, including Bitfinex, Bitstamp, Binance, Coinbase Pro, and Poloniex.

Because Gekko is more of a grassroots project, it doesn’t have an active support staff. Though, there is an active forum of individuals that use Gekko that can help users fix issues and implement trading strategies.

Gekko isn’t the nicest looking platform but is one of the most private and secure systems due to it being open-sourced and it not sending data to a centralized repository.

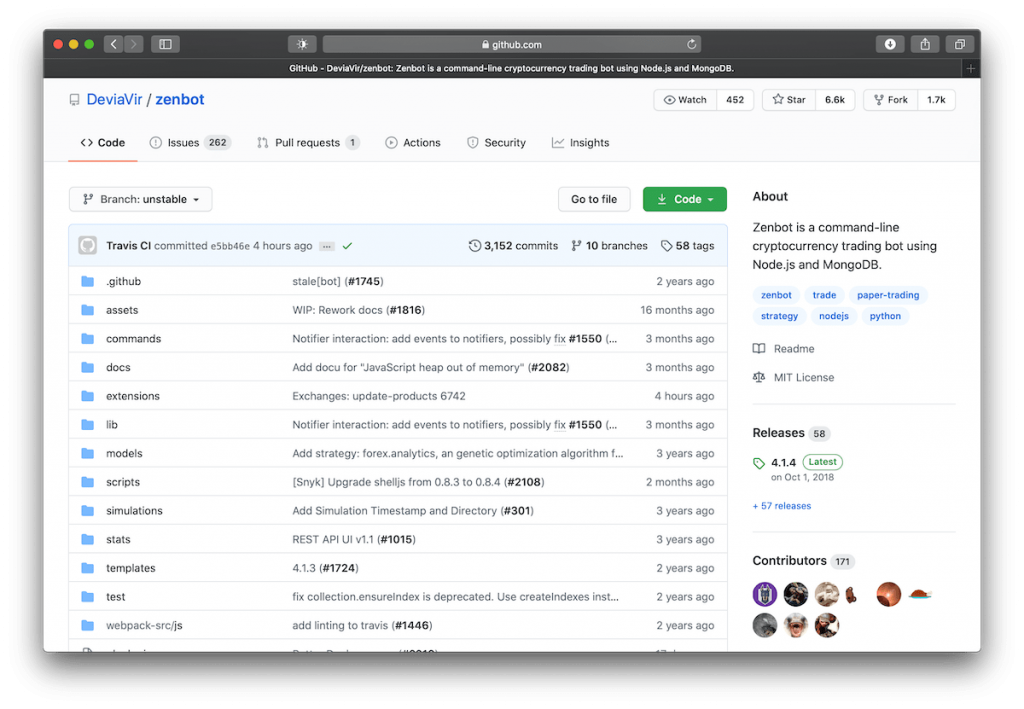

5. ZenBot

ZenBot is similar to Gekko in that it is also an open-source cryptocurrency trading bot. It is also available on GitHub, allowing users to freely download and modify the code as they please to suit their trading needs. ZenBot is notably without a proper user interface, so its use may be reserved for more advanced users that have knowledge of command-line interfaces.

It supports top exchanges like Bittrex, Gemini, Coinbase Pro, and Poloniex. Like Gekko, ZenBot does not have an active support staff due to its open-source nature, though there are likely many online that would be willing to help out if a new user runs into barriers.

What separates ZenBot from Gekko is that it is purportedly more suited for high-frequency trading than its competitor.

6. Haasonline

Haasonline is a platform focused on allowing one to rapidly create, backtest, and deploy automated strategies across spot, futures, and options platforms. Exchanges supported by the system include BitMEX, Binance Futures, and Deribit.

Like CryptoHopper, Haasonline has a marketplace of algorithms, signals, and much more, giving traders the opportunity to leverage other traders’ skills while also monetizing their own. This system allows for copy trading, meaning you can execute the exact same trades as another authorized user.

This platform’s biggest benefit is its Visual Editor, which allows users to visualize the logic of trading scripts, coded in HaasScript. HaasScript is a language developed by the company that allows one to “create complex automated trading algorithms, technical indicators, generate and interpret signals, and much more.” This Visual Editor tool allows those with little programming experience to bolster their trading experience.

As Quintus de Haas, HaasOnline’s chief technology officer, once commented on the matter:

“With the introduction of the Visual Editor, which utilizes HaasScript, we have made it easy for users who don’t code to create scripts.[…] Our development team has been working extremely hard to create and refine the world’s most advanced scripting language and tools for crypto automation.”

Haasonline’s systems are focused on maintaining privacy while still allowing for proper automation and customizability. To do so, there are system requirements to using the software, meaning that you can’t exactly set up a Haasonline trading bot on your phone or old computer. Those system requirements can be found on the company’s website.

Though, the company just released a cloud edition of its software, lowering the barriers to entry. This new system allows individuals to access Haasonline trading software on the go, including on their phones and tablets.

Haasonline is relatively expensive compared to other systems. For a 12-month plan, a “Beginner” package will cost the equivalent of $700 in Bitcoin, the “Simple” package will cost the equivalent of $1,200 in Bitcoin, and the “Advanced” package will cost $2,000 in Bitcoin. The company only accepts Bitcoin, citing its commitment to the cryptocurrency space. All packages support all basic features, though the capacity or limits of the bot are lifted as you move up the tier list.

7. TokenSets

Finally, TokenSets or Set. The reason why Sets are mentioned last on the list is that while they are trading bots by definition, they differ from the status quo.

Sets differ from traditional trading bots in that they’re focused on preserving decentralization and are less intensive/active than software mentioned earlier — CryptoHopper or Haasonline being two examples. As TokenSets’ website explains:

“Sets are tokens with built-in asset management strategies. Each Set is a smart basket ERC-20 token of crypto assets that automatically balances based on the strategy you choose.”

There are two types of Sets: “Robo” (or automated) Sets and Social Trading Sets.

Robo Sets follow basic technical analysis-based strategies, like buying Ethereum with a stablecoin when it crosses above a moving average, maintaining 50/50 exposure to both Ethereum and Bitcoin, or moving between stablecoins and Bitcoin as the relative strength index moves in certain ways.

Social Trading Sets follow the direction of prominent traders and fund managers in the cryptocurrency space, such as blockchain analytics firm ByteTree, Brave New Coin’s Josh Olszewicz, and many others. Even you could have your own Social Trading Set — it’s just a matter of applying. These are less trading bots than Robo Sets, but changes to your portfolio are done in an automated manner.

Sets complete all trading through decentralized exchanges, and holders of Sets are given a token to represent their share of the pool of funds. The decentralized nature of the protocol, which disallows traders from stealing your deposits, has allowed Sets to experience strong adoption thus far.

The drawbacks of Sets is that fees of certain Sets can be high, trades are slower and more expensive due to the relative inefficiencies of decentralized exchanges, and it’s hard to implement advanced trading strategies due to Ethereum’s block time of 14 seconds. There’s also the cost of paying transaction fees, as interacting with Sets requires one to transact with Ethereum-based smart contracts.

Notably, Sets have recently gained the advocacy of Jason Williams, the co-founder of Morgan Creek Digital, a cryptocurrency fund. Williams has recently begun to promote his use of the LINK Profit Taker Set, which maintains majority exposure to Chainlink’s LINK cryptocurrency.

Honorable Mentions

The platforms we listed are far from the only crypto trading bots there are. The following are a few honorable mentions that also have a place in a Bitcoin investor’s arsenal.

8. GunBot

GunBot is a trading bot focused on speed and flexibility in strategies. It allows one to create their own parameters for trading or to use tried and true presets that can be found on-platform. What makes GunBot unique is that it can trade an unlimited number of crypto trading pairs simultaneously while most other platforms have restrictions. The bot also offers a one-time license fee, meaning that you don’t have a pesky recurring bill that other crypto platforms charge.

9. Stacked

Stacked is a crypto trading platform with a sleek, modern user interface that gives one the ability to either create or purchase and implement trading strategies. Unfortunately, the platform is currently in beta, supporting only four crypto exchanges, most of which have margin features: ByBit, FTX, Binance, and BitMEX. The way in which this platform differentiates itself from most other trading bots is that it has a big focus on cryptocurrency indices. Stacked offers pre-built diversified crypto “baskets,” similar to how Vanguard or other Wall Street fund managers offer investment vehicles for a basket of bonds or even the S&P 500.

10. Shrimpy

Shrimpy is a trading platform focused on the social aspect of trading and security. Along with offering the ability to copy the strategies of top traders, it has a Two-Factor Authentication system and a way of storing API keys that may appeal to the more security-focused Bitcoin trader. The platform is one of the best premium trading bots with free features. Its free “Hodler” plan provides portfolio tracking tools while its “Professional” plan at $13 a month offers one the ability to utilize advanced features. Shrimpy also has an “Enterprise” plan that focuses on tax optimization and portfolio rebalancing algorithms.

Should You Use an Automated Bot?

With the crypto market becoming more liquid and complex than ever due to the introduction of new coins and exchanges, the need for trading bots seems to be more apparent than ever before.

Trading bots have the ability to allow one to gain exposure to advanced investment strategies and features while minimizing the stress, time, and emotions affiliated with an actively-managed portfolio.

Yet not everyone needs one. Many are content with simply holding Bitcoin or other cryptocurrencies in anticipation that they will rally over time. And others may not want to take on the risk of using automated systems due to the risks affiliated with active portfolio management.

In short, both strategies can make money and lose one money, it just depends on how one HODLs and/or uses trading bots.