Crypto has been great for investors worldwide who need a way to easily and securely transfer money. However, the method of exchange and the fact that it’s unregulated makes cryptocurrency a target for hackers. These hackers are occasionally successful when they attempt to steal cryptocurrency from businesses and consumers. In fact, a shocking $1.1 billion in cryptocurrency was stolen in just the first half of 2018 alone.

Unlike with banks and other regulated industries that can find your money and return it to you if it’s stolen, when your cryptocurrency is stolen, it’s gone forever.

The main targets are crypto exchanges, not cryptocurrency wallets. Let’s take a look at some of the biggest crypto exchange hacks that have happened in history.

The first major hack: Mt. Gox (2011 and 2014)

The Japan-based Bitcoin exchange Mt. Gox began operating in 2010. By 2011, it was the largest Bitcoin exchange in the world. In June 2011, a hacker figured out Mt. Gox’s auditor’s credentials and used them to transfer 2,609 Bitcoins to a new address. Mt. Gox didn’t have the keys to the new address, and the exchange ended up shutting down for a few days. Accounts that had at least $8,750,000 were affected as the price of a Bitcoin plummeted to just one cent.

To their credit, Mt. Gox was able to sustain themselves in the market even after the attack. By 2014 the exchange was handling nearly 70 percent of all Bitcoin transactions worldwide.

In February 2014, the company suddenly froze all Bitcoin withdrawals and soon announced that they had lost 850,000 BTCs that were worth, at the time, around $350 million. It turns out hackers had been consistently taking money from the wallets of Mt. Gox customers since 2011. The company eventually found 200,000 BTCs, but they couldn’t come back from the bad PR or the mistrust of their customers.

The reason for both major hacks? Many attribute it to plain old mismanagement that led to security risks from storing the cryptocurrencies in a hot wallet. The company’s CEO Mark Karpelès was recently found guilty of deliberately tampering with financial records to hide the hacking events from investors and the public.

The largest hack: Coincheck (2018)

Coincheck lost about $500 million worth of NEM tokens to hackers in 2018 and remains the biggest hack in the history of digital currency. The reason for the hacks comes down to a lack of security. Hackers were able to access the funds and transfer them relatively easily. While this type of hack would have likely shut down a crypto exchange back in 2011, by 2018 the crypto market was large enough to sustain such a blow. Coincheck is still in operation, and all the victims have been repaid. The hack led to new security measures across crypto exchanges.

Other notable bitcoin exchange hacks in history

Bitfloor (2012)

Bitfloor’s hack was small but still significant. In 2012, hackers managed to get their hands on unencrypted private keys that the exchange was keeping online for backups. They ended up stealing 24,000 BTC (around $250,000 at the time) in an overnight heist. The exchange was able to issue refunds, but it still ended up closing.

Bitfinex (2016)

Bitcoin exchange Bitfinex was hacked in August 2016 and lost $77 million in BTC. It took nearly three years for authorities to track the two brothers they believe to be responsible for the hack. The brothers allegedly created clones of major cryptocurrency wallets and exchanges, then sent the clones to phishing sites. Everyone who had currency stolen from their wallet has been reimbursed.

BitGrail (2018)

Coming in behind Mt. Grox is BitGrail with the third-worst cryptocurrency hack of all time. Hackers stole $187 million worth of Nano from this Italy-based exchange in February of 2018. There was some speculation that the hack was all a hoax, created to cover up asset mismanagement. BitGrail CEO Francesco Firano was recently sentenced to return as much of the stolen money as possible to investors after a court ruled that BitGrail was at fault for not properly securing investors’ wallets.

Binance (2019)

The latest notable hack was Binance’s $40 million theft. 7,000 Bitcoins were stolen due to a data breach as hackers gained access to API Keys and two-factor codes. However, it did not take long for the first cryptocurrency exchange by volume to recover. One week later, all trading, deposits, and withdrawals resumed as normal.

The exchange covered the entire amount with its own funds and vowed to improve its security measures. Users still have faith in CZ’s leadership and the Binance exchange, as it is still the number one crypto exchange by adjusted volume.

Keep your investment safe

The majority of crypto hacks are the result of mismanagement and a lack of exchange security. To keep your cryptocurrency safe, you are better off using your own wallet rather than in an exchange. Always remember, “not your keys, not your crypto”.

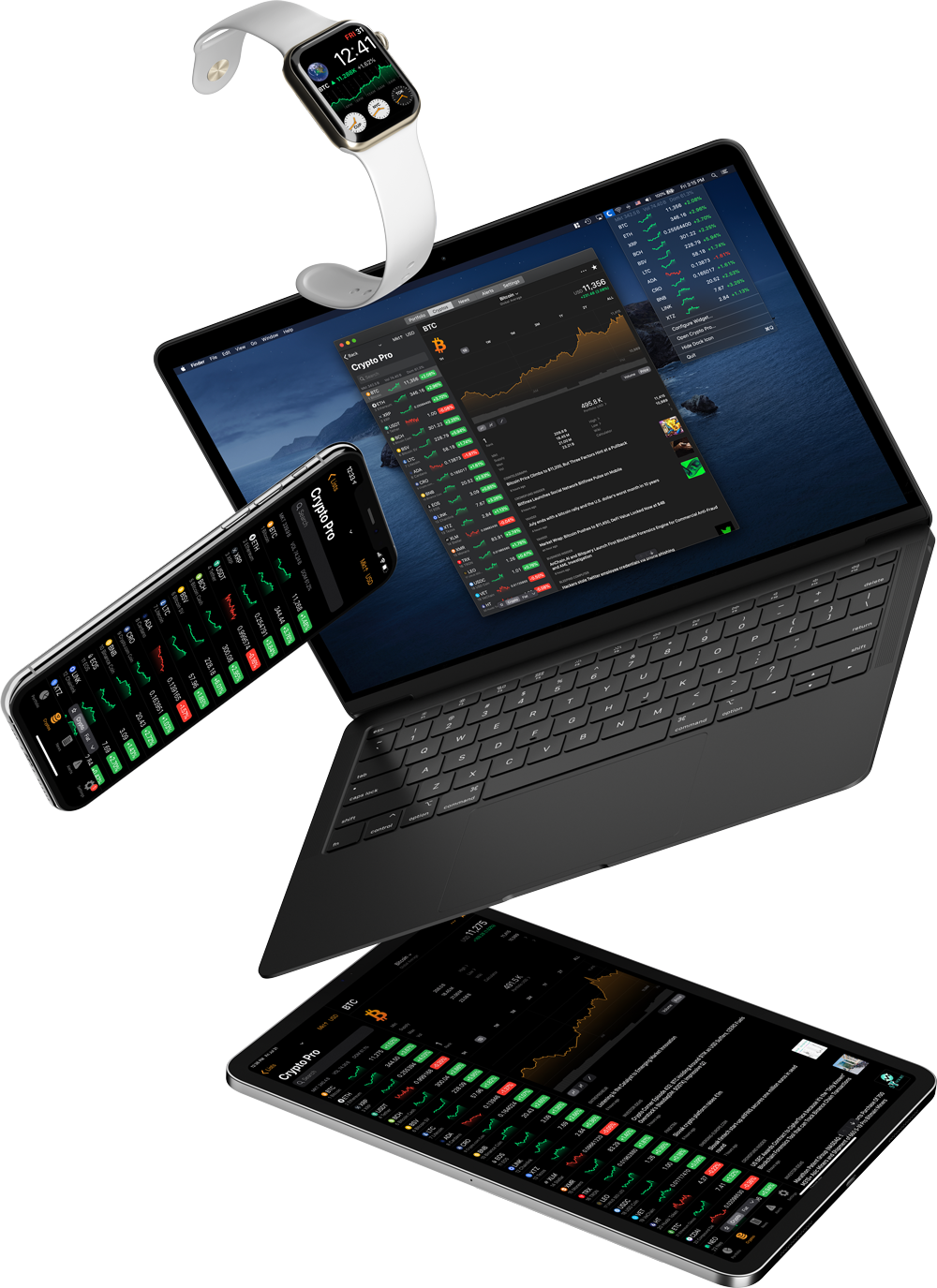

Keep track of your cryptocurrency portfolio and stay up to date on the latest in the crypto world with Crypto Pro – A coin tracker that doesn’t track you back.

Stay in Touch

We like to keep in touch with like-minded people. You can follow us on Twitter, join our Telegram Group, like us on Facebook, and even send us an email at [email protected] if you need assistance or have a suggestion in mind.