An overview of the different types of Crypto wallets you can use

When it comes to storing cryptocurrency, you have a lot of options for wallets. Which type you choose to go with will depend on what type of cryptocurrency you’re storing and what your needs are. Different types of wallets are better for different types of investments. They have different levels of security as well.

The two main storage types of cryptocurrency wallets are hot and cold. Hot wallets are connected to the internet, which makes them less secure but easier to use for daily transactions. Cold wallets are stored offline, which makes them more secure because they aren’t vulnerable to malware or virus attacks. They’re better used for storing cryptocurrency instead of spending it.

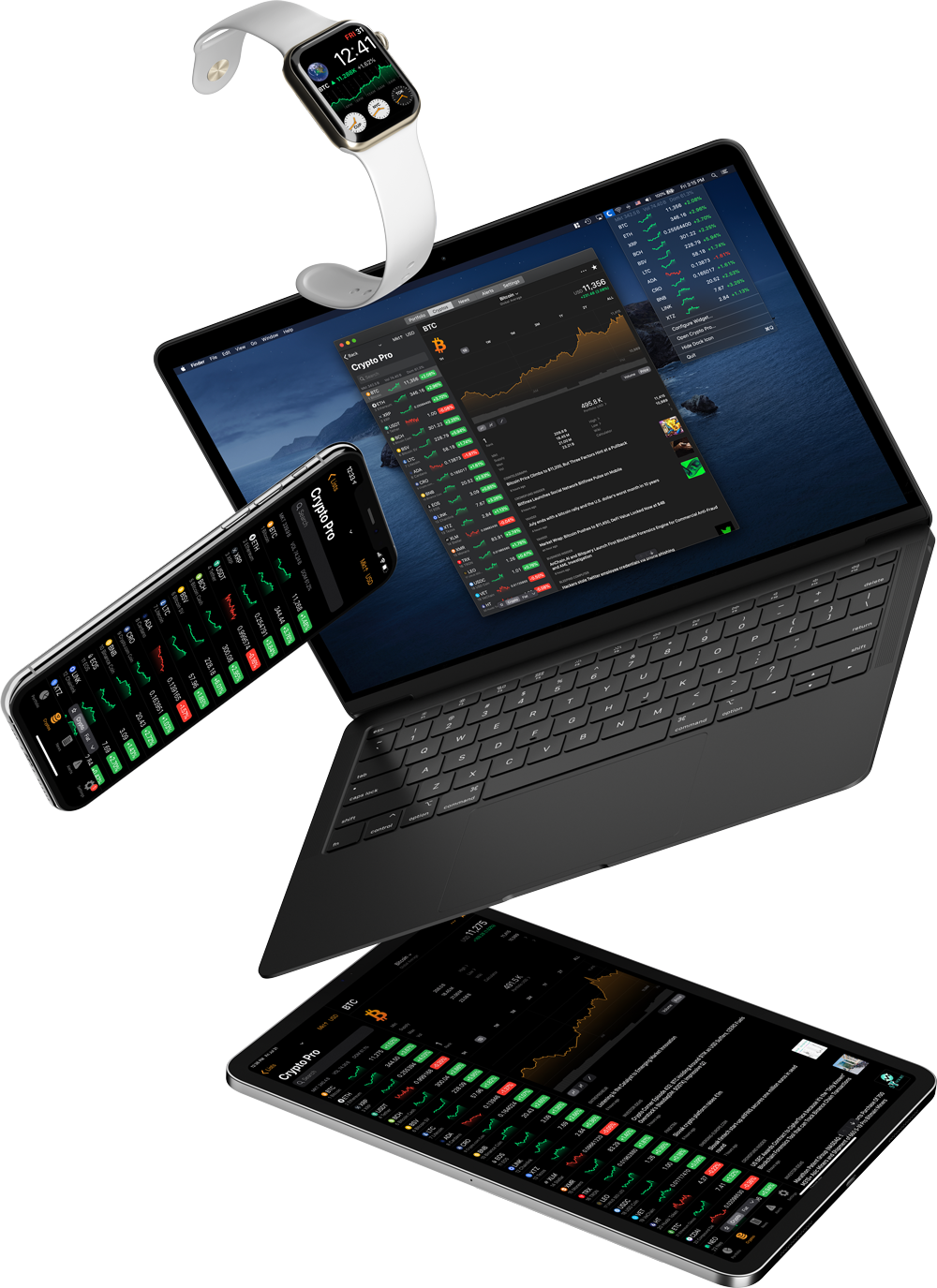

Here’s a rundown of the 5 most popular types of cryptocurrency wallets in order of least secure to most secure. Whichever one you choose, remember that you can connect it with Crypto Pro’s app to track your portfolio from anywhere.

1. Online/Web Wallets — Hot Wallet

Some places call them online wallets, others call them web wallets. If you have ever stored your credit card information in your browser, you’re already using a web wallet. Cryptocurrency web wallets operate the same way, by running in your browser.

The big advantage of using an online wallet is convenience. An online wallet gives you access to your cryptocurrency from the internet, as long as you’re connected to the cloud. Online wallet providers automatically store your crypto private key onto their server, which makes it easy for you to access your cryptocurrency and make crypto-payments.

The fact that your private key is stored on your provider’s server is the security concern with web wallets. It’s more secure for you to store the private key. If the server gets hacked, your information is vulnerable. Further, some online wallet companies operate on exchanges, which, as we’ve learned from the past, can leave your information and your cryptocurrency vulnerable since hackers are more likely to break into exchanges than anywhere else to steal cryptocurrency.

In general, you should only use an online wallet if you have a small amount of cryptocurrency. Don’t store large amounts of cryptocurrency in an online wallet because of the security risks.

Pros: Easy to use; good for on-the-go transacting

Cons: Least secure method of storing cryptocurrency; risk of downloading viruses

2. Mobile Wallets — Hot Wallet

You can use mobile wallets through an app on your phone. They work the same way as other mobile payment applications, like Apple Pay, and let you pay for goods and services when you’re in physical retailers that accept cryptocurrency as a form of payment. This makes them a convenient option for anyone who is spending rather than saving cryptocurrency. While some online wallets have a mobile option, wallets that are specifically mobile wallets have added security in the form of QR codes.

There are some downsides to mobile wallets. First, any wallet that’s stored on your phone is at risk if you lose your phone. Plus, like any other application that’s tied to the internet, they come with the risk of malware or mobile viruses.

Pros: Easy to use for on-the-go transactions

Cons: At risk for malware and viruses; can lose assets if you lose your phone

3. Desktop Wallet — Hot or Cold Wallet

Whether a desktop wallet is hot or cold depends on whether or not the desktop is (or ever has been) connected to the internet. If you use a desktop wallet when it’s not connected to the internet, then it’s a cold wallet.

Desktop wallets are software packs created by wallet companies that you download directly to your desktop. They’re convenient because you can access them from your computer through the wallet program instead of through a browser. Because you can transact offline, they’re safe from malware and virus threats. Also, your private keys aren’t stored on a third-party server with desktop wallets. Instead, you control the encrypted key. As long as you don’t lose it, your cryptocurrency is safe from hackers.

Pros: Convenient if you trade on your computer; safer than online or mobile wallets

Cons: Less convenient for on-the-go trading and usage; you need to back up your computer regularly

4. Paper Wallets — Cold Wallet

Paper wallets are cold wallets that have a mixture of reviews when it comes to how secure they are. While generally cold wallets are more secure than hot wallets, there are some risks that come with paper wallets. You have to print out your private and public keys (hence, paper) and then you can send funds a few ways. First, you can transfer money to your wallet’s public address. You can also send your cryptocurrency by scanning the paper wallet’s QR code or by entering your private key.

To ensure your security when generating your keys, you should unplug from the internet while your keys are being generated and then wipe your history after the keys have been created. Make sure to run a malware check before generating keys.

Because your key is stored offline, paper wallets are considered cold wallets, which makes them more secure than online wallets. Nobody can hack into your information, as long as you keep the printed paper wallet in a very secure location. However, you need to be extremely careful when printing your key to ensure that nobody can access your information before, during, or after printing.

Pros: Not susceptible to hackers; you control your keys

Cons: Printing can be tricky; if you lose your printout it can be very hard to access your money

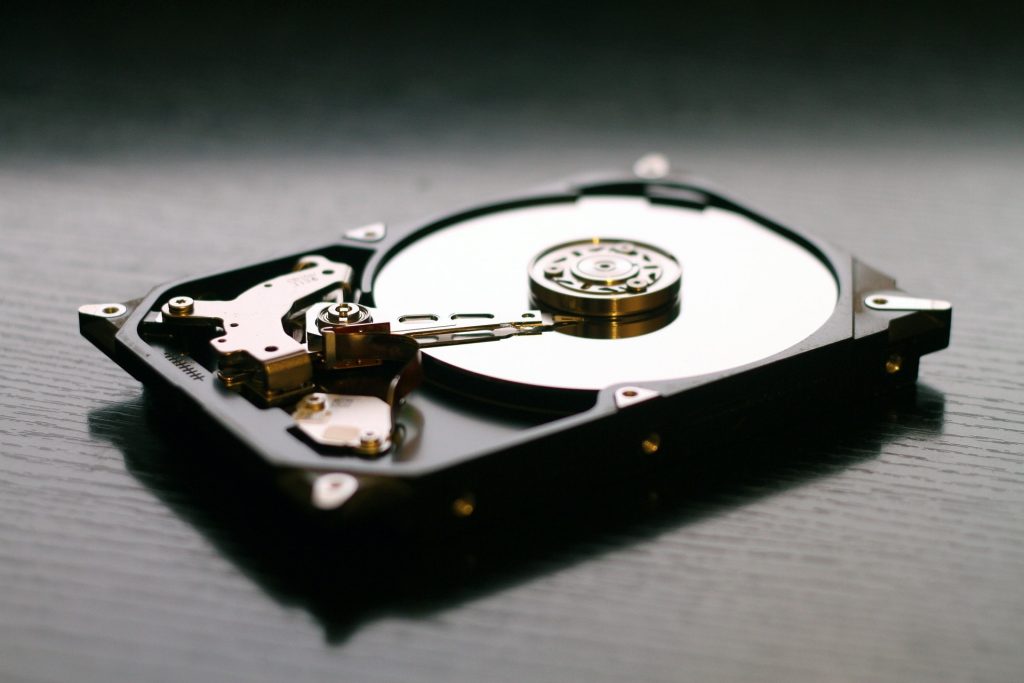

5. Hardware Wallet — Cold Wallet

Hardware wallets are significantly safer than the other types of wallets we’ve talked about so far because they store your private keys on a separate device that functions basically like a USB drive. You can still make online transactions, so they have the convenience of an online wallet but with the added security of offline storage. One of the most common hardware wallets is the Ledger Nano shown above.

The main disadvantage of hardware wallets is the cost. While you can get a mobile wallet or online wallet for relatively cheap, sometimes as low as $10, hardware wallets can cost $150 or more. But, when you consider that your risk of losing cryptocurrency is drastically lower when you use a hardware wallet, you might find that it’s worth the upfront cost. Further, hardware wallets aren’t as convenient as online or mobile wallets for making transactions on the spot. They’re better for storing cryptocurrency than for spending it.

Pros: Very secure; cold storage; good for storing large amounts of cryptocurrency

Cons: Most expensive type of cryptocurrency wallet; less convenient for on-the-go transactions

Track your investment

No matter which type of wallet you choose, you can track your cryptocurrency portfolio using Crypto Pro – The all-in-one coin tracker, news, alerts, and more.